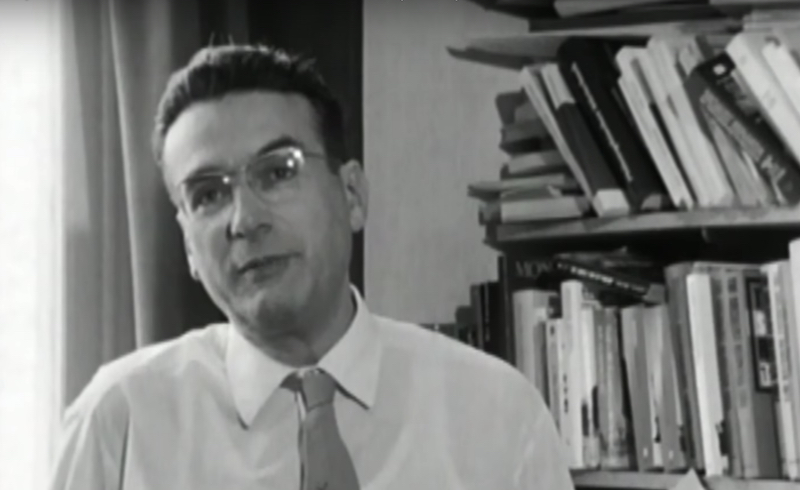

By Ernest Mandel, World Outlook, 1963

|

| Ernest Mandel |

The Cuban magazine Nueva Industria – Revista Economica, organ of the Ministry of Industry, published two polemical articles in issue No. ? (October 1963) of great interest, one written by Ernesto Che Guevara and the other by Commandante Alberto Mora, Minister of Foreign Trade. This polemic testifies to the vitality of the Cuban Revolution in the field of Marxist theory, too. It deals with a number of questions of the utmost importance in the construction of a socialist economy: role of the law of value in the economy during the epoch of transition; autonomy of enterprises and self-management; investments through the budget or by means of self-investment, etc. Involved in these issues is the problem of the ideal model for the economy in the epoch of transition from an underdeveloped country, a problem of absorbing interest to the Bolsheviks during the 1923–1928 period and which arose again, even if on a rather low theoretical level, in Yugoslavia, Poland and even in the Soviet Union in recent years.

The Law of Value in the Economy During the Epoch of Transition

The question of the “application” of the theory of value in the planned and socialized economy of the epoch of transition has been subjected to the worst confusion, mainly because Stalin, in his last work, posed it in a both gross and simplistic way: “Does the law of value exist (sic) and does it apply in our country? ... Yes, it exists there and it applies there.” This is an evident truism. To the extent that exchange occurs, commodity production survives, and exchange is thereby objectively governed by the law of value. The latter cannot disappear until commodity production withers away; that is, with the production of an abundance of goods and services.

But this does not answer the concrete question around which turns the fundamental discussion begun in 1924-25 between Preobrazhensky and Bukharin which has continued to develop, with ups and downs, among Marxist economists and theoreticians up to now: to what exact degree and in what sphere does the law of value apply in the economy during the epoch of transition?

Stalin himself, while muddying the problem, had to admit a fact which the Khrushchevist economists are nevertheless beginning to draw into question; namely, that in the “socialist” economy, the law of labour-value cannot be the regulator of production, that is, cannot determine investments.

In developed capitalist economy, the law of value determines production through the play of the rate of profit. Capital flows toward the sectors where the rate of profit is above the average and production increases there. Capital recedes from the sectors where the rate of profit is below the average, and production decreases there (at least relatively). When the means of production are nationalized, so that there is neither a market for capital nor its free entry and withdrawal, nor even the formation of an average rate of profit with which the rate of each particular branch can be compared, clearly there is no longer a possibility for the “law of value” to be directly the “regulator of production.”

If, in an underdeveloped country which has carried out its socialist revolution, the “law of value” were to regulate investments, there would flow preferentially toward the sectors where profitability is the highest in relation to prices on the world market. But it is precisely because these prices determine a concentration of investments in the production of raw materials that these countries are underdeveloped. To escape from underdevelopment, to industrialize the country, means to deliberately orient investments toward the sectors that are least “profitable” for the time-being according to the criterion of the long-term economic and social development of the country as a whole. When it is said that the monopoly of foreign trade is indispensable for industrializing the under-developed countries, this means precisely that it cannot be accomplished until these countries are able to “pull the teeth” of the law of value.

But perhaps this qualification applies only to the “law of value on the world market”? Cannot the law of value at least alter investments on the national scale, once world prices are left aside? This is wrong again. The industrialization of an underdeveloped country cannot be carried out rapidly and harmoniously except by deliberately violating the law of value. [1]

In an underdeveloped country, and precisely because of its underdevelopment, agriculture tends from the beginning to be more “profitable” than industry, handicrafts and small industry more “profitable” than big industry, light industry more “profitable” than heavy industry, the private sector more “profitable” than the nationalized sector. To channel investments according to the “law of value,” that is, according to the law of supply and demand of commodities produced by different branches of the economy, would imply developing monoculture for the export trade by priority; it would imply preferential construction of small shops for the local market rather than steel plants for the national market. The construction of comfortable lodgings for the petty-bourgeois or bureaucratic layers (an investment corresponding to “effective demand”) would have priority over the construction of low-cost homes for the people which clearly must be subsidized. In short, all the economic and social evils of underdevelopment would be reproduced despite the victory of the revolution.

In reality, the decisive meaning of this victory, of the nationalization of the means of industrial production, of credit, of the transportation system and foreign trade (together with the monopoly of the latter), is precisely to create the conditions for a process of industrialization that escapes from the logic of the law of value. Economic, social and political priorities, consciously and democratically chosen, take the lead over the law of value in order to lay out the successive stages of industrialization. Priority is placed not on immediate maximum returns, but on the suppression of rural unemployment, the reduction of technological backwardness, the suppression of the foreign grip on the national economy, the guarantee of the rapid social and cultural rise of the masses of workers and poor peasants, the rapid suppression of epidemics and endemic diseases, etc., etc.

That is why the industrialization of the workers states follows a different road from that of the capitalist countries where industries are built beginning with the sectors that will most easily satisfy “effective demand.”

To violate the law of value is one thing; to disregard it is something else again. The economy of a workers state can disregard the law of value only at the price of losses to the economy which could be avoided, of useless sacrifices imposed on the masses, as we shall later demonstrate.

What does this mean? In the first place, that the whole economy must be carried on within the framework of a strict calculation of the real costs of production. These costs will not determine investments; these will not automatically go toward “the least costly” projects. But to know the costs means to know the exact amount of subsidies which the collectivity grants the sectors which it has decided to develop by priority. In the second place, that it is necessary to have a stable yardstick for these calculations; without stable money, no rigorous planning. In the third place, that all sectors where economic or social priorities do not dictate any preference are to be actually guided by the “law of value,” (for example, different crops aiming at the domestic market). In the fourth place, so longs as the means of consumption remain commodities, and aside from the commodities and services deliberately subsidized or distributed free by the state (pharmaceutical products, school and training materials, books, etc.), the preferences of the consumers will freely operate on the market the law of supply and demand will affect prices, and the plan will adapt its projected investments to these oscillations (within the limits of what is available in finances, equipment, raw materials, etc.).

In the light of these initial remarks, we can consider the importance of the two problems raised in the Guevara-Mora polemic: What is value? Are means of production commodities in the transitional epoch? Mora affirms that value is not essentially abstract human labour; that it is “a relation existing between the limited disposable resources and the growing needs of man” (p. 15). Still better: he holds that value is a “category created by man under certain conditions and for certain (!) ends” (p. 15).

It is clear that we are faced here with a subjective deformation of the Marxist concept of labour-value, of which Marx specified the essence to be abstract human labour. It is not by chance that Mora refers to the “neo-Marxist” Soviet economists [2], who have been attacked, in the USSR itself, and rightly so, as wanting to introduce surreptitiously the marginal theory of value. His conception, according to which the “law of value is the economic criterion for regulating production” in the epoch of transition (p.17) – while he affirms that it is not the only regulator – necessarily involves the notion according to which “exchange of the means of production” occurs even when these are completely nationalized, that “sale of commodities” occurs even when these means of production pass from one nationalized enterprise to another, and that the “contradictions” between the state enterprises justify the assertion that a “change in ownership” occurs at the time of these exchanges (p.19). All these affirmations are contrary to the reality and to Marxist theory. On all these questions, Che Guevara is entirely right against Mora.

Mora states that if in investments, one leaves aside the law of value, one must “pay the price”; in doing this, you automatically limit the social resources available to satisfy other needs. This is true, and we, likewise, underline the necessity for strict calculation of production costs in all fields. But in limiting oneself to this economic truth, the social content of the epoch of transition is done away with; that is, in abstracting from the class struggle, Mora leaves out a whole important side of the problem.

In fact, it is impossible to operate in the economy of the epoch of transition – any more than in any other economy containing different social classes – with aggregates like “social revenue,” “social costs,” “social price of investments,” without at the same time posing the question: “Who is to pay this price to whom?

The society of the epoch of the transition to capitalism to socialism is not homogeneous. In conducting an appropriate policy of investments, of prices, wages, foreign trade, etc., the workers state can act in such a way that the social benefits of priority investments (numerical reinforcement of the working class; elevation of its standard of living, skill, culture and consciousness; reinforcement of its leading role in the state and economy; accentuation of its participation in political life, etc., etc.) are paid economically by other social classes; the residue of the former owning classes; imperialism; the small commercial entrepreneurs and independent peasants. In an expanding economy, this economic price, paid particularly by the merchants, artisans and independent peasants can moreover be accompanied by a rise in their standard of living, on condition that this rise is less than it would have been in the framework of the “free play of the law of value” (thanks, for example, to a progressive income tax). [3]

The Law of Value and Foreign Trade

All the preceding evidently constitutes only a general framework for replying to the specific problems which the question of economic calculation and the orientation of investments raises in each particular workers state. Here, Mora is right when he stresses (p. 18) that in a small country like Cuba, which depends strictly on foreign trade for the current functioning of its industry (spare parts and raw materials) and for the equipment of its new enterprises, the necessity for rigorous economic calculation is imposed with all the more reason than in a big, largely autarchic country like the Soviet Union.

Exports are made according to prices on the world market. So that these exports will not constitute a constant drain on the national economy (they must be met in any case in order to keep industry and industrialization going through imports), it is necessary that the production costs of exported goods should as a whole be below the prices obtained on the world market. It is necessary to fix the objective on progressively suppressing all exports at a loss, so that exports are not only a means supplying the national economy but, in addition, an important source of accumulation, a means of defraying part of the expense of industrialization – a part of the costs of not observing the law of value on the national market! – from abroad. The tendency for current prices of sugar to rise on the world market creates, moreover, a favorable framework for the success of such a policy. The progressive diversification of exports, to render the Cuban economy independent of future fluctuations of current sugar prices on the world market, must point to the selection of other export, products where production costs remain below the prices obtained abroad (that is, average prices on the world market).

But Mora mixes up the need to carry out all these calculations in the most strict way with the extension of the field of application of the law of value in the Cuban economy. The two phenomena are not identical; they can even be directly contradictory.

The law of value determines the exchange value of commodities according to the quantity of labour socially necessary to produce them. The concept of “socially necessary” labour is determined in turn by the average level of the productivity of labour in a country, and by the concept of the effective demand of society – which must never be confounded with human needs or social needs from an objective point of view. In an underdeveloped country like Cuba, all production of many industrial branches can correspond to an “effective demand,” that is, all labour in these branches can appear as “socially necessary,” despite a very low level of productivity. The reference to the law of value, far from thereby resolving the problem of rapid improvement in the productivity of labour, of the technological transformations which these industries must undergo, can only obscure it. Because the law of value will have a tendency to keep alive archaic enterprises, as long as the state of scarcity exists, from the moment there ceases to be free movement of capital and free imports of commodities which could stimulate competition with these enterprises.

Far from being a field of application of the law of value, the dependence of Cuba on foreign trade thus implies the necessity of economic calculation of comparative international costs, which could provide a choice of economic criteria, independently of any rigid “law.” The necessity to assure the country’s supply of spare parts and raw materials imposes a certain volume of exports, even if these are carried out at a loss. The necessity to maintain and develop the existing level of industries dependent on foreign supplies imposes searching, as quickly as possible, for profitable exports in relation to prices on the world market – even if this means switching investments toward branches that are already profitable in relation to the national market (branches that already sell their commodities at their exchange value). The possibility of exporting at a profit, of gaining supplementary resources from exports, of transforming trade into a constant source of socialist accumulation, will moreover permit just the liberation of the economyfrom the tyranny of the “law of value,” that is, will permit the development of new industries despite the fact that their production costs at the beginning will be higher than the prices of imported products, without lowering the standard of living or the rate of accumulation in the country. This is an aspect of the real dialectics of the dependence on foreign trade and the play of the law of value that is decidedly more complex than Comrade Mora thought!

The Law of Value and Autonomy of Decision at the Enterprise Level

In the debate which has raged in some of the workers states, the problem of the area of application of the law of value is intimately linked with the problem of autonomy of decision at the enterprise level in the field of investment. The Yugoslav authors have even formulated with regard to this a veritable new dogma which requires critical analysis: “Without the right of the self-management collectives to dispose of a considerable part of the social surplus product, no genuine self-management.” [4] This analysis must examine the problem from two aspects: economic efficiency (criteria for choosing one investment project rather than another), social and political efficiency (success in the struggle against the bureaucracy and bureaucratization).

The more backward a country is, the more conditions of almost universal scarcity rule not only in the means of production sector but also for much of the industrial means of consumption (at least for the great majority of the population), and the more detrimental the practice of self-investment is, the more detrimental is it to permit the self-management collectives to determine for themselves the projects for priority of productive investments.

It is evident in fact that under conditions of almost general scarcity of industrial commodities, almost all the investment projects can be economically profitable, no matter how gross the economic errors that are committed. Almost every profitable industrial or agricultural enterprise (providing funds for investment) is like an island in a sea of unsatisfied needs. The natural tendency of self-investment is therefore to attend to what is most pressing, both locally and in each sector.

In other words: if the self-management enterprises hold large funds for self-investment, they will have a tendency to orient their investments either toward the commodities which they lack the most (certain equipment goods; raw materials; auxiliary products; emergency sources of energy), or toward the commodities which their workers or the inhabitants of the area lack the most. Thus, criteria of local or sector interest are placed above national interests, not because the law of value is “denied,” but precisely because it is applied! This means, once more, to orient industrialization toward the “traditional road” which it followed in the historic framework of capitalism, in place of reorienting it according to the requirements of a nationally planned economy.

An attempt can be made to reconcile national planning requirements and allocating self-managed enterprises considerable funds for self-investment. The means chosen for this aim can be a levy-tax in behalf of national development funds and equalization funds for regional development. This is evidently a step in the right direction, but it does not at all resolve the problem.

Since an underdeveloped economy is characterized precisely by the fact that the enterprises of high productivity are still the exception and not the rule, it is sufficient to leave them a part of their net surplus product and the inequality of development between the industrialized localities and the non-industrialized localities, the inequality of development and of revenue between the archaic enterprises which enjoy only an average level of productivity and the enterprises technologically “up to date” will increase instead of diminishing. It is necessary, moreover, to insist on this fundamental idea of Marxism: any economic freedom, any “autonomy of decision” and any “spontaneity” increases the inequality so long as there exist side by side strong and feeble enterprises or individuals, rich and poor, favored and unfavored from the point of view of location, etc. This is the reason why, it should be noted in passing, that according to Marx the mechanism of the law of value leads to its own negation; competition inevitably ends in monopoly.

The economic logic of a planned economy therefore speaks completely in favor of productive investment by budgetary means at least for all the big enterprises. What must be left to the enterprises is an amortization fund sufficiently large to permit modernization of equipment with each renewal of fixed equipment (gross investment). But all netinvestments should be made in accordance with the plan, in the branches and places chosen according to preferential criteria selected for the society and its economy as a whole. In this respect, too, the thesis of Comrade Guevara is correct.

The problem has been obscured, above all in the USSR, through associating it with the problem of heightening the material incentives in enterprises. Numerous Soviet economists have criticized the stimulants still employed today in the economy of the USSR to incite the enterprises (?) to carry out the plans. This criticism is in general pertinent. It has but to repeat what anti-Stalinist Marxists have said critically for many years. Yet, it is only necessary to examine closely the arguments of these economists to see that what is involved in reality is heightening of material incentives for the bureaucracy for whom the growth of revenues must in some way be the essential stimulus for the expansion of production in the enterprises.

This is where certain partisans of self-management, particularly in Yugoslavia, maintain that decentralization of the decisions on investment would be a powerful guarantee against bureaucratization. This thesis is based on a fallacy. The Yugoslavs are right in stressing that the power of the bureaucracy grows in relation to its freedom in disposing of the social surplus product. But the technicians and economists of the planning commission “dispose” of the surplus product only in the form of figures on paper; the real power of disposal is situated at the level of the enterprise. [5] The more that means other than consumption funds (distributed revenues and social investments) are left at the free disposal of the enterprises, the more is precisely bureaucratization stimulated, at least in a climate of generalized scarcity and poverty; also the greater the temptation becomes for corruption, theft, abuse of confidence, false entries – temptations that do not exist at the level of the planning commission, if only because of multiple checks. The concrete experience of Yugoslav “decentralization” has shown, moreover, that it is an enormous source of inequality and bureaucratization at the level of the enterprises.

But doesn’t the possibility of complete centralization of the means of investment at the state level create the danger of the economic policy as a whole favoring the bureaucracy, as was the case in Stalinist Russia? Obviously. But then the cause does not reside in the centralization itself; it lies in the absence of workers democracy on the national political level. [6] This means that a genuine guarantee against bureaucratization depends on workers management at the enterprise level and workers democracy at the state level. Without this combination, even the autonomy of the enterprises will eliminate none of the authoritarian, bureaucratic and (often) erroneous character of economic decisions made at the government level of the plan. With this combination, the centralization of investments – priorities being democratically established, for example through a national congress of workers councils – would not encourage bureaucratization, but, on the contrary, suppress one of its principle sources.

The Law of Value and Self-Management

“Heightening material incentives” in the enterprises cannot be a “stimulant” in the question of investments. But “heightening material incentives” in the self-management collectives can actually stimulate continual growth of production and productivity among the enterprises.

Certainly, under a regime of genuine socialist democracy, creative enthusiasm, the free development of all the capacities of invention and organization of the proletariat, constitute a powerful motor for the growth of production. But it would be a grave idealist and voluntarist error to suppose that in a in a climate of poverty – inevitable in an underdeveloped country immediately following the victory of the socialist revolution – this enthusiasm could last long without a sufficient material substructure.

The example of the Soviet Union, where the proletariat gave proof of an enthusiasm and spirit of self-sacrifice without parallel in the first years after the October Revolution, is instructive in this respect: a long period of deprivation ended inevitably in mounting passivity of the workers, daily material concerns taking precedence over attentiveness to meetings.

It is therefore imperative to link self-management to the possibility for the workers to immediately judge the success of each effort at increasing production by the elevation of their standard of living. The simplest and most transparent technique is that of distributing a part of the net revenue of the enterprise among the workers in the form of one or more months of bonus wages, the amount increasing or diminishing automatically with the level of revenue. The increasing collective material interest of the workers in the management of the enterprises moreover is superior to piece wages, inasmuch as it does not introduce division and conflicts in the workers’ collectivity, inasmuch as it corresponds better to contemporary technique, which place less and less importance on individual output and more and more importance on the rational organization of labour.

Self-management (and not mere workers control) seems to be the ideal model for organizing socialist enterprises. But it by no means hinders more or less unlimited competition among the enterprises, which flows from their autonomy in the domain of prices and investments. This autonomy cannot but reproduce a series of evils inherent to the capitalist regime: monopoly positions exploited in the formation of prices and revenues; efforts to defend these monopolies by “hiding” discoveries and technical improvements; waste and duplication in the field of investments; high cost or errors in decision, revealed a posteriori on the market (including the shutting down of enterprises); reappearance of unemployment, etc., etc. Useless and detrimental from the economic point of view, it by no means constitutes a sufficient guarantee against bureaucratization, as we have indicated above.

In this connection, the polemic of Lenin and Trotsky against the theses of the “Workers Opposition” is still completely valid. Marxism is not to be confused with the doctrine of anarcho-syndicalism. The genuine guarantee of workers power lies on the political level; it is on the state level that it must be established; any other solution is utopian; that is, unworkable in the long run and a source for the reappearance of a powerful bureaucracy.

For all these reasons, self-management does not at all imply wider recourse to the “law of value” in relation to centralized planning. [7] The fundamental data of the problem remain the same. It is necessary to carry out strict calculations of production costs to show in the case of each commodity whether its production has been subsidized or not. But nothing calls for the conclusion that prices must be “determined by the law of value,” that is, by the law of supply and demand. If such a conclusion still has some meaning with regard to the means of consumption, it is senseless for the means of production which, we repeat, are not commodities, at least in the great majority of cases. And even means of production which are still commodities – those produced by the private or co-operative sector for the delivery to the state, and which the state furnishes to private enterprises or co-operatives – cannot be “sold at their value” without encouraging under certain conditions private primitive accumulation at the expense of socialist accumulation. But, if the means of production are not sold “at their value,” the “value” of the means of consumption is itself profoundly modified.

Prices are, then, instruments of socialist planning and cannot be anything else in the epoch of transition from capitalism to socialism. If you say instrument of planning you likewise say instrument for determining the distribution of the national revenue between consumption and investment, an instrument for determining the distribution of revenues among the different classes and layers of the nation. To leave the determination of this distribution to the “law of value,” is to leave it in the final analysis to the “laws of the market,” to the “law of supply and demand,” that is, to economic automatism. And economic automatism would rapidly take us back to an economy of the semi-colonial type.

But to say that prices cannot be determined by the law of value does not at all signify that they can be independent of the latter. Society can never distribute more values than it has created without progressively destroying its accumulated wealth and impoverishing itself increasingly in the absolute sense of the term. The total sum of prices must therefore be equal to the total sum of value of the commodities produced (granting that there has been no monetary depreciation). The distribution of certain products – in goods or vouchers – below their value (subsidies!) automatically signifies a distribution of other products above their value. Without strict calculation of production costs; without book-keeping aided by an objective criterion; without a kind of double entry system that faithfully registers, for each product, alongside the price fixed by the state, the real cost and the subsidy (or the tax) there is not only no possibility for genuine scientific planning, there is above all no stimulus for the fundamental economic dynamic of the epoch of transition – the dynamic that progressively elevates one new branch of industry after another to the point of rendering it “competitive” in relation to prices on the world market, up to the time socialism announces its next triumph when socialist industry as a whole operates with a productivity superior to that of the most advanced capitalist industry.

At the moment, the “law of value” could theoretically govern the dynamic of the workers state (or more exactly: the workers states as an international whole; because it appears excluded that this situation could be first obtained “in a single country”). But at the precise moment when it is on the point of triumphing, its reason for being disappears. The highest level of productivity attained under capitalism in all its branches cannot be surpassed without approaching such a level of abundance that commodity production withers away. In the workers state “law of value” cannot channel investments except to the precise degree that it withers away and to the degree that along with it all the economic categories, products of a relative scarcity of material resources, likewise wither away.

Notes

1. “Planned economy in the transitional period, while founded on the law of value, violates it nevertheless at every step and establishes relations among the different economic branches, and between industry and agriculture in the first place, on the basis of equal exchange. The state budget plays the role of a lever for forced accumulation and planned distribution. This role must be increased in accordance with the latest economic progress. Credit financing dominates relations between the coercive accumulation of the budget and the fluctuations of the market, insofar as the latter enter in ... If the domestic Soviet market is ‘freed’ and the monopoly of foreign trade suppressed – exchange between the city and countryside will become much more equal, the accumulation of the village (I refer to the capitalist accumulation of the farmer, the ‘kulak’) will follow its course, and it will soon be seen that Marx’s formulas likewise apply to agriculture. Once on this road, Russia would rapidly become a colony that would serve as the base for the industrial development of other countries.” (Leon Trotsky: Stalin Theoretician. Available in French in Ecrits 1928–40, Tome I, p. 106) [Available in English in different translations as Stalin as a Theoretician in Militant, 15 September–11 December 1930 and Stalin as a Theoretician in International Socialist Review, Fall 1956 & Winter 1957.]

2. Among others, Novochilov, Kantorovitch and Menchinov. This question underlies the famous debate on the possible use of profit as the sole criterion in carrying out the plan. In reality, these economists are the spokesmen of the economic bureaucracy, who demand increased rights for the directors of enterprises – particularly the right to freely dispose of a part of the “invisible funds” (fixed equipment).

3. From 1924 to 1927, the Stalinist faction violently accused the Left Opposition – Preobrazhensky in particular – with wanting “to increase the prices of industrial products.” Preobrazhensky had simply proposed that industrial products could be sold “above their value” to the village, which could have been tied in perfectly with a progressive lowering of the sales price in view of the rapid growth of the productivity of labour. But when the Stalinist faction made the turn to accelerated industrialization, it increased the prices of industrial consumers goods through extremely high indirect taxes. While in 1928, the tax on turnover was not above 17.9% of the real turnover of retail trade, it rose to 78.1% in 1932, and in 1936, the nominal turnover of this trade was 107 billion rubles, of which taxes accounted for 66 billion rubles and the real turnover only 41 billion! (L.H. Hubbard: Trade and Distribution in the Soviet Union)

4. Thus Milentiji Popovic, in an article entitled Self-management and Planning:

“On the other hand, in the sector of expanded social reproduction, in perfecting the system of investment on the basis of the new relations, our results are less conclusive, although the first steps have been taken in this direction. The establishment of non-administrative relations, of economic relations, in this sphere, reverts quite simply to the establishment of credit-interest (!) relations, and to taking them as the basis ...

“One must first of all counteract the contradiction which arises from the fact that the resources servicing social reproduction are deducted exclusively through administrative measures (taxes, duties, contributions) thus leaving free the organization of labour without the latter on the other hand becoming the ‘proprietor;’ the organization of labour evolves, in fact, into a unique system of credit in which these resources are at one and the same time ‘theirs’ and ‘common’ (article 11) ...

It is possible to avoid, on the other hand, having subjective and political considerations as the only ones to be taken into consideration at the time of the adoption of the decisions concerning investments. It goes without saying that this method cannot and must not ever be pushed to its final conclusion. But a system can be constructed in which the political decisions will bear on the general orientation of the political economy while the distribution of the means destined for investment is carried out in accordance with the credit mechanism, according to financial and material (!) criteria fixed with more or less precision. In operating in this way the process of expanded reproduction is likewise ‘depoliticalised.’ This ‘depoliticalization’ is not absolute. It must be carried out to the degree that bureaucratism must be deprived of its base in this sphere as in the others.” (My emphasis – E.M.). – Current Questions of Socialism, No. 70, July–Sept. 1963, pp. 67–68.

5. This obviously does not apply to cases where raw materials, equipment, goods and sometimes even means of consumption are centrally distributed, becoming veritable hotbeds for germinating corrupted bureaucrats.

6. “Only the co-ordination of three elements, state planning, the market and Soviet democracy, can assure correct guidance of the economy of the epoch of transition and assure, not the removal of the imbalances in a few years (this is utopian), but their diminution and by that the simplification of the bases of the dictatorship the proletariat until the time when new victories of the revolution will widen the arena of socialist planning and reconstruct its system.” (Leon Trotsky: The Soviet Economy in Danger. Available in French in Tome I of Ecrits 1928–1940, p.127). [In English, in a different translation, see The Soviet Economy in Danger in Militant, 12 November 1932–7 January 1933.]

7. Certain Yugoslav authors take quite correct positions in this respect. See, for example, Dr. Radivoj Uvalic: “While the open market can be widely utilized, it cannot be the sole or even the principle regulator of the socio-economic relations of a socialist country.” And again: “The importance of the planned guidance of economic development under the conditions of socialism lies first of all in the possibility that is offered of considering profitability from the point of view of the economy as a whole and not from the point of view of each particular unit of the economy ... This is the case in all branches of high concentration of capital (?), such as the production of the means of production and raw materials, which could be never developed sufficiently on the basis of the accidental play of the market, with the rate of profit as the sole stimulate.” (In: Socialist Thought and Practice, No. 6, pp. 47 and 55)

No comments:

Post a Comment