By Kamran Nayeri, February 26, 2014

1. Introduction

In his “Understanding the Present-Day World Economic Crisis—An Eco-Socialist Approach,” Section III, Saral Sarkar aims to provide “The Deeper Causes of the Crisis.”

The title of the article is somewhat misleading as it is about what has come to be called the Great Recession in the United States that began in December 2007 and by some accounts continues to this day. It is an argument for natural limits to growth as the cause for the Great Recession.

It is my good fortune to have come to know Saral. Reading his 1999 book Eco-Socialism or Eco-Capitalism: A Critical Analysis of Humanity’s Fundamental Choices was an immensely educational experience for me. He has contributed to Our Place in the World (that I founded and edit), including through sharing his writings. Although we use different frameworks for analyzing and understanding the crisis of our time (for my own view see Economics, Socialism and Ecology: A Critical Outline Part 1 and Part 2 ), I believe we share a common vision of a future that can bring about harmony in society and with the rest of nature.

It is in this context that I find Saral’s argument for the causes of the Great Recession unconvincing. In what follows, I will first outline Saral’s argument. Next, I will offer a criticism of it. Finally, I will note what insight the limits to growth offers and delineate some of its limits in understanding and challenging problems posed by the capitalist civilization. I hope this criticism would be an occasion for an enriching discussion for all those who wish to make a difference in making a better world.

2. Saral’s Reasoning

In essence, Saral’s argument is that existing explanations of the crisis are inadequate or “superficial” because the Great Recession is really caused by natural limits to growth not economic or social ones. Below is a summary of Saral’s reasoning broken into three separate claims. I will add key sentences from Saral’s essay motivating each claim for ease of reference but the reader may wish to review the short section in Saral’s essay:

FIRST CLAIM. A SECULAR, LASTING RISE IN PRIMARY COMMODITY PRICES INITIATED THE CRISIS

In the period leading to the crisis, prices of oil and “the energy resources coal, gas and uranium as well as industrial metals like copper, zinc, iron and steel, tantalum etc.” rose sharply.

The price increases were secular and lasting rather than cyclical. “These price rises must not be mixed up with the usual inflations of the past, which were triggered mainly by excessively high wage demands of the working people (the so-called wage-price spiral).”

“…[T]he main cause of the said price rises is the rise in the extraction costs of the most important raw materials.” (emphasis in original).

“Also the environmental services provided by nature for us are important resources for any kind of society…The costs of maintaining such resources in an industrial society have also increased along with the costs of extracting important resources like the ones mentioned above.”

SECOND CLAIM. HIGH PRIMARY COMMODITY PRICES RESULTED IN DECLINE IN PURCHASING POWER OF MOST PEOPLE

THIRD CLAIM: DECLINE IN PURCHASING POWER RESULTED IN MORTGAGE DEFAULT, HOUSING CRISIS, THUS THE GREAT RECESSION

3. Criticism

Each of the three claims outlined above is essential for the overall thesis of the essay. However, each claim is problematic as I will discuss below.

PROBLEMS WITH THE FIRST CLAIM: THERE IS NO EVIDENCE FOR A SECULAR, LASTING RISE FOR PRIMARY COMMODITY PRICES.

Let’s begin with noting that (1) Saral does not offers any time series data to support his claim for a secular rise in primary commodity prices, and, (2) he does not cite any references to the literature that establish such claim.

Thus, an undue burden is on his reader to verify this claim. I am not a natural resource economist who studies primary commodity prices. However, I took it upon myself to conduct a “first look” at the literature to help me think through Saral’s reasoning. I came away with the opposite of what he claims.

For Saral a secular, lasting rise of primary commodity prices is the cause of the Great Recession. However, the literature on primary commodity prices supports (1) that the shape rise in some primary commodity prices in the earlier part of the 2000s was the result of rapid industrialization in China and other “emerging economies,”and, (2) that this was a cyclical phenomenon not a secular and permanent change. In fact, soon after the crisis started primary commodity prices dropped.

Let’s take a look at some evidence from the literature on primary commodity prices. The investment bank and wealth manager Credit Suisse’s report (July 27, 2011) entitled “Long Run Commodity Prices: Where Do We Stand” (July 27, 2011) offers a detailed account. Exhibit 2 of this report shows a sharp rise of 210% in the Credit Suisse Commodities Benchmark since 2000. However, in the bank’s opinion this was a cyclical rise in the index due to rapid and large demand.

“In our 13 January 2011 report, A Macroeconomic Proxy for Basic Materials Demand, we argue that much of the increase in commodity prices has been due to very strong commodity demand. As a complement to that analysis, this note assess prices against very long-run patterns, in an effort to establish where current prices are relative to the historical experience.

“While many economists and commentators have suggested that despite short-run volatility, over time commodity prices tend to fall, our analysis suggests that other than for agricultural products, most commodities do not have a clear long-run trend (up or down) with most effectively moving around a relatively consistent average over the past 110 years. Given the differences, to understand how recent movements fit within longer-run dynamics it is necessary to analyze each of the individual commodities.” (my emphases)

The rest of the report examines individual primary commodity prices. While some primary commodity prices, this report cites oil, iron ore and gold, were at their highest level in the past 110 years, others, like like grain prices are lower than historical average going back to 1850. Copper prices that Saral cites showed a sharp rise before the onset of the crisis in 2008 but they have dived down since and historical data shows a stable secular price (Appendix 1, Martin Stuermer, November 2013) . Prices of other metals, like Aluminum, have actually fallen during this entire period. For other studies that confirm the same the reader can consult Hirochi Yamada, March 2013, Steven McCorriston, June 2012.

Based on this evidence, I must conclude that (1) there is no secular and permanent rise in prices of the primary commodity prices taken as a group leading to the Great Recession, and (2) that the cyclical rise in the overall index was by driven mostly by oil and some metals as the consequences of increasingly industrialization demand from China and other “emerging economies,” and (3) that this cyclical rise in some primary commodity price was not a significant causal factor in the Great Recession. In fact, I know of no study study that makes such a claim.

How about the supposed rise in the costs of environmental/ecological “services” that Saral claims? Saral offers no data or references to back up this claim. In a subsequent section given to a discussion of the GDP, Saral raises the problems of “defensive and compensatory costs” but there is no attempt to document them and link them empirically to the Great Recession.

While I entirely agree with the proposition that overtime production of some primary commodities will entail greater harm to nature and society, I feel unease with the notion of linking this phenomenon with the bourgeois economic doctrine as “defensive and compensatory costs.” The basic idea is that stock of physical, human and natural capital has to be replenished. To view humans and nature as “stock of capital” is an exercise in bourgeois alienation. In my view, such approach takes the discussion into the dominant economics (bourgeois) paradigm and undermines an alternative ecological socialist paradigm. The radical societal change will come only with a break with the economic (bourgeois) paradigm not in continuity with it. I will return to this in the last part of this commentary.

Since there was no secular rise in primary commodity prices and there is no evidence that a similar rise is the costs of environmental/ecological “services” hit the working masses purchasing power then these cannot be the cause of the massive mortgage default and the housing crisis in the U.S. as Saral claims. I have no choice but to conclude that Saral’s case for a “limits to growth” explanation of the Great Recession fails to get off the ground.

PROBLEMS WITH THE SECOND AND THIRD CLAIMS: WHY PURCHASING POWER OF THE WORKING PEOLLE FELL IN THE UNITED STATES?

But perhaps the rise in the cyclical prices of some commodity prices such as oil, iron ore and gold (that Credit Suisse report cites) or energy and metals as Saral claims squeezed the budget of working people and caused the housing crisis?

As I noted earlier, I know of no such a claim that is empirically supported. Still, it is an interesting hypothesis. However, even if one can show that a cyclical rise in price of some primary commodities contributed to the onset of the Great Recession it would not support a natural limits to growth argument. For that, one needs to establish a secular, long-term rise of primary commodities that form a significant portion of costs of mass production and consumption.

Further, how can any analysis ignore the economic and financial context of the mortgage default and the housing crisis, financial crisis when a firm like Lehman Brothers failed, AIG and the three giant automakers had to be rescued, and trillions of dollars were given to the biggest U.S. banks to remain solvent?

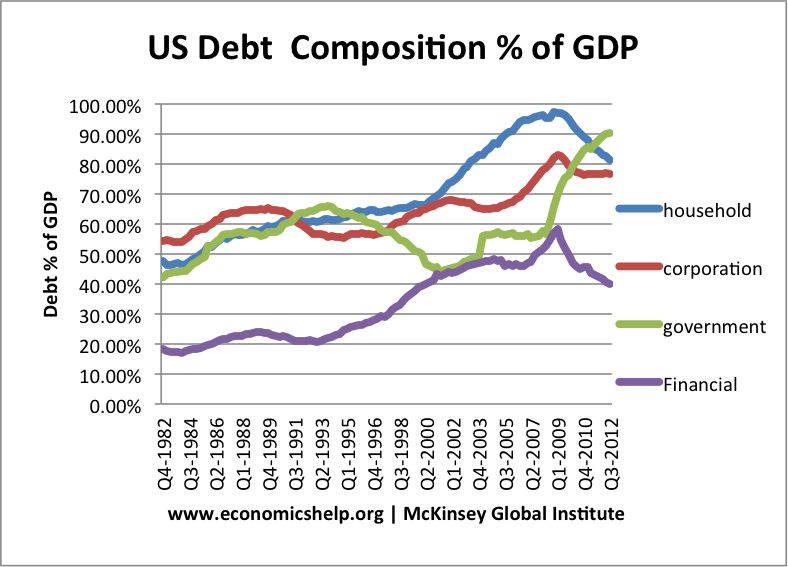

As the above figure from the McKinsey Global Institute shows, household debt, corporate debt and financial debt grew unsustainably from early 1980s to 2008. household debt was a staggering $12.68 trillion (100% of GDP), corporate debt about 85% of GDP and financial debt about %60 of GDP. The government debt fell through the Clinton years in part due to the fast growing economy (tax revenues increases) and in part due to austerity measure such as his signature “welfare reform” (cut in spendings). Given these data, it was not a question whether there will be a deep crisis but when and how it would break out.

Could anyone suggest that this long term exponential growth in debt was because of natural limits to growth? Or should we look elsewhere?

This commentary is not a place to discuss the causes of the Great Recession (there is never a single cause for a crisis of this proportion and there are many studies to cite and discuss). But we need to consider the financial conditions of the U.S. working class because of how Saral singles them out in his argument. The key fact to recall is the much studied and well understood phenomenon of declining real wage of workers and rising income inequality since the 1970s (for a journalist review of this see, for example, this 2012 Washington Post article) and this 2014 New York Times article).

Why have real wages fallen and income inequality risen? Because of a concentrated attack on the working class by the employers and their state. Why? To restore capitalist profitability.

As a number of Marxist economists established in a series of published academic articles in the 1980s and early 1990s (see various issues of Review for Radical Political Economics; also see references below for the explanation of the Great Recession that cover this period as well), the average rate of profit in the U.S. did decline from the end of World War II to the mid-1970s (marked by the world recession of 1973-75). A stagnation ensued. Keynesian policies added high inflation resulting in stagflation.

The capitalist class went of a neoliberal offensive marked by Thatcher and Reagan anti-labor offensive that targeted the miners union in Britain and the air traffic controllers union in the U.S. respectively. The assault also targeted the social wage resulting in Clinton’s “welfare reform” but has continued to targeting social security (retirement insurance), medicare (old age medical insurance) and medicaid (health insure for the very poor), food stamps, child nutrition program, etc. The assault has been comprehensive, targeting all earlier social gains from women’s right to safe abortion to environmental regulations to citizens’ right. And it has been internationalized.

Saral slights unionists, socialists and others for pointing out this frontal assault that has lasted now for well over three decades as “superficial” explanation for the crisis. However, with almost all productivity gains going to the top 1% of the population and continued use of fiscal and monetary policies to support various asset inflation schemes to combat stagnation of the U.S. economy (see, Laurence Summers's December 15, 2013 article), it is hard no to believe that bursting of the housing bubble had a non-economic, nonsocial cause. Seven years later, despite of lower primary commodity prices, historically low interest rate brought about by massive monetary policy intervention (basically a gift to the employer class), with corporations awash in cash, the U.S. economy is still dormant, Europe is toying with deflation, and China and the “emerging economies” facing a crisis. The key feature of the capitalist world economy in the past 40 years had been the dominance of financial capital; that is, those who Lenin called the coupon clippers.

Given all these facts, why not take a look at what the Marxists economists can provide as explanation for the Great Recession? Interested readers may consult Anwar Shaikh's, “The First Depression of the 21st Century” 2010; Fred Moseley’s, “The U.S. Economic Crisis” 2011; Duménil's and Levy’s The Crisis of Neoliberalism 2011; and Robert Brenner's “Reasons for the Great Recession” for a sample of such views.

So, why does Saral call Marx’s theory of the tendency of the rate of profit “unsatisfactory” and Marxist explanations of the Great Recession “superficial?” What alternative theory of the capitalist system would Saral propose or endorse? After all, anyone who wants to analyze any aspect of the functioning of the capitalist system should begin with some theory of the beast and how it lives.

In fact, Saral’s own essay reveal this necessity. For example, he attribute the “usual inflations of the past” to mainly “high wage demands of the working people (the so-called wage-price spiral).” But what does constitute “high wage demand by the working people?” High by whose standard? Further if real wages have been falling for 40 years what accounts for the stagflation in the U.S. in the 1970s? It could not have been high wage demands, or could it? Is not “wage-price spiral” argument part of the mainstream (bourgeois) macroeconomic theory that blames workers for capitalist inflation (the other is “demand spiral,” commodity demand)? Why should an ecological socialist subscribe to such an anti-labor “theory”? What is wrong, for example, with Marx’s argument in Wage, Price and Profit (1865)?

Similarly, in the summary of his argument quoted above Saral argues that due to “diminishing availability of affordable resources a growing number of workers lose their jobs or are forced to work only part-time, then they are producing no goods and services or less of them than before.” Again, the problem of unemployment and falling standards of living, including increasing nutritional deficiency, homelessness, lack of health insurance, and misery of the working people in the United States is blamed not on the capitalist anti-labor policies but on the nature law of diminishing returns.

4. Limits to the Limits to Growth Perspective

To conclude this commentary, it is necessary to place the limits to growth argument in context.

A. The Historical Context

Limits to Growth (1972) was the title of the first report commissioned by the international think-tank Club of Rome. The report has been updated every 10 years since. The 1972 report’s authors, Donella H. Meadows, Dennis L. Meadows, Jørgen Randers, and William W. Behrens III of Massachusetts Institute of Technology, used a computer model they built and named World3 to simulate the consequence of interactions between the Earth's and human systems focusing on the exponential economic and population growth dynamics in the face of finite resources.

A key finding was that

The socialist critique of the Limits to Growth also included an ideological bias for growth perceived as progress (in Marxist ideology growth of “forces of production” is desirable). The bias is most visible in socialist hostility to all criticism of exponential human population growth as “Malthusian,” that is reactionary and anti-working class. However, the socialist critique included a valid point. Limits to Growth model incorporates many assumptions based on mainstream socio-economic theories. That is, Limits to Growth proponents sidelined, if not entirely denied, economic, social and ideological criticism of the capitalist system in favor of arguing for natural limits to growth. It was argued that if these natural limits are not respected the population and the economy will go into a sudden and precipitous decline. Of course, the reality of the present day world includes all such limits, economic, social, and natural, to the capitalist civilization.

B. Limits to Growth and Green Capitalism

/https://public-media.smithsonianmag.com/filer/Futurism-Got-Corn-graph-631.jpg) |

| Source: Meadows, D.H., Meadows, D.L., Randers, J. and Behrens III, W.W. (1972) (Linda Eckstein) |

In his “Understanding the Present-Day World Economic Crisis—An Eco-Socialist Approach,” Section III, Saral Sarkar aims to provide “The Deeper Causes of the Crisis.”

The price increases were secular and lasting rather than cyclical. “These price rises must not be mixed up with the usual inflations of the past, which were triggered mainly by excessively high wage demands of the working people (the so-called wage-price spiral).”

“…[T]he main cause of the said price rises is the rise in the extraction costs of the most important raw materials.” (emphasis in original).

“Also the environmental services provided by nature for us are important resources for any kind of society…The costs of maintaining such resources in an industrial society have also increased along with the costs of extracting important resources like the ones mentioned above.”

“The rising costs of extracting or conserving these resources mean that less and less of them are available to most people.”

“…[I]f one says that a person’s real income is going down, then it is tantamount to saying that this person is getting less and less resources…” “This exactly is happening today in most of the world.”

“Moreover, a large and growing number of workers are finding only temporary and part time jobs.”

“It should not, therefore, surprise anyone that in 2007, in the USA, the housing boom came to an end and home-owners began defaulting. It began with the subprime mortgages, but soon also the established working class and then the middle class started losing their ownership homes.”

“Trade unionists and all kinds of leftists may blame the current misery of the working people on brutal capitalist exploitation, on the weakness of the working class, on speculators without conscience, on greedy bankers, on globalization that has caused relocation of many production units to cheap-wage countries, etc. Of course, at first sight, all these explanations are partly correct. But on closer look one cannot but realize that when, on the whole, there are less and less resources to distribute because it is getting more and more difficult to extract them from nature….then, even in a better capitalist world with a strong working class, at best a fairer distribution could be achieved, not more property for all.” (emphasis in the original).SARAL’S OWN SUMMARY: Saral summarizes his argument as follows:

“Workers in the broadest sense produce goods and services by using resources (including energy resources), tools and machines, which are also produced by using resources. If due to diminishing availability of affordable resources a growing number of workers lose their jobs or are forced to work only part-time, then they are producing no goods and services or less of them than before. Now, since most goods and services are, in the ultimate analysis, paid for by (exchanged with) goods and services, it is unavoidable that these workers can get less goods and services from other people.” (emphasis in the original).

Each of the three claims outlined above is essential for the overall thesis of the essay. However, each claim is problematic as I will discuss below.

As the above figure from the McKinsey Global Institute shows, household debt, corporate debt and financial debt grew unsustainably from early 1980s to 2008. household debt was a staggering $12.68 trillion (100% of GDP), corporate debt about 85% of GDP and financial debt about %60 of GDP. The government debt fell through the Clinton years in part due to the fast growing economy (tax revenues increases) and in part due to austerity measure such as his signature “welfare reform” (cut in spendings). Given these data, it was not a question whether there will be a deep crisis but when and how it would break out.

"If the present growth trends in world population, industrialization, pollution, food production, and resource depletion continue unchanged, the limits to growth on this planet will be reached sometime within the next one hundred years. The most probable result will be a rather sudden and uncontrollable decline in both population and industrial capacity.” (Limits to Growth, p. 23, 1972)

The publication of Limits to Growth stirred much interest and debate but also much hostility that eventually derailed the healthy discussion that ensued. The hostility to Limits to Growth came largely from the free marketeers on the right whose ideology is wedded to the 250 years capitalist growth and industrialization.

Thus, the authors of the report and Club of Rome have not rule out socially and ecologically “sustainable capitalism” or “sustainable growth” if “appropriate measures” are taken in time. In 1972, they wrote:

"It is possible to alter these growth trends and to establish a condition of ecological and economic stability that is sustainable far into the future. The state of global equilibrium could be designed so that the basic material needs of each person on earth are satisfied and each person has an equal opportunity to realize his individual human potential.” (Ibid, p. 24)

As a result Limits to Growth has largely served as an intellectual platform for the Green Capitalism ideology. One of the original authors of the 1972 report, Jørgen Randers, has recently published 2052: A Global Forecast for the Next Forty Years (2012) that scales back some of the earlier more alarmist predications (e.g. in case of energy), avoids making predictions and offers proposals for individual action (not systemic proposals).

At the fringe are small number of ecological socialists and anarchists who subscribe to the general notion that there are natural limits to growth but retain a critical attitude towards the exiting capitalist order and Green Capitalism. We should value Eco-socialism or Eco-Capitalism (1999) where Saral devotes the bulk of the book to refute Green Capitalism. At the same time, he correctly criticizes the productivist vision of socialism. Both these contributions make the book a must read for anyone interested in ecological socialism.

Thus, to adopt a natural limits to growth perspective it is necessary to link it to a critical social theory that can explain how we have arrived at the current critical juncture in history and how to overcome the existing globalized capitalist system that has generated and perpetuates the conditions causing the crisis.

C. Limits to Growth and Externalities

In his essay, Saral devote a section to a criticism of the GDP using K. William Kapp's criticism of the GDP accounting for not addressing “defensive” and “compensatory” costs defined as costs to replenish physical, human and natural capital. Kapp is considered the founder of ecological economics, a discipline dedicated to integrating environmental and ecological aspect of the economy into the mainstream theory.

“Defensive” and “compensatory” costs are externalities defined as cost or benefit of economic activities to third parties or society at large. The negative externality is pervasive and well known such as industrial pollution. The positive externalities also exists. A bee keeper’s price of honey does not reflect the gain from pollination in the almond orchard next door. Market failure refers to the failure of the price mechanism to capture such costs or benefits. It should surprise no one that these costs and benefits are not included in the GDP. One could, as Kapp and ecological economists have tried, attempt to do so. However, it is not a prudent approach and that it cannot possibly succeed. How does one go about economic account for all types of ecocide, pain and suffering of farm animals, mass extinction of species, melting of the Earth’s ice caps? Arguments for amending the GDP to account for various externalities are made within the economics (bourgeois) paradigm regardless of anyone’s intent. Concerns for the species going extinct is made from an ecocentric paradigm even if those who make it don’t realize it. The two paradigms are not reconcilable.

On the other hand, the limit to growth argument offers a powerful argument for a rise in negative externalities and decline of the positive externalities (witness the plight of the honey bee or bats, both are major pollinators). Whereas cost of production of natural resources will increase given enough time due to diminishing returns it is quite possible that prices decline in intermediate terms using new technologies. But negative externalities are likely to increase. Thus, from an ecological point of view, the costs outstrip the benefits while from an economic point of view it is the other way around. Just consider fracking for natural gas, shale oil and mountain top mining for coal.

Thus, it is more fruitful to use limits to growth perspective as a way to discuss increasing environmental and ecological costs than to try to use it as the exclusive or “deeper” cause for the Great Recession.

D. Limits to Growth as a Paradigm

Saral and others have talked about natural limits to growth as paradigm shift. In a sense it is. Socialist and most other radical traditions have focused on social and economic issues. The growth paradigm has become part of these traditions as critical as they are of the capitalist system. Natural limits to growth offers a new way to think about contradictions of class societies. I say this being fully aware that Saral and other supporters of limits to growth perspective mostly or exclusively focus of industrial societies. But if one accepts the fact of ecological/environmental cause for the decline and disappearance of pre-industrial civilizations then it becomes clear the limits to growth has operated throughout human history and, in some instances, even prehistory. It’s impact in the earlier times was local or regional. Under industrial globalized capitalist system it’s impact is planetary.

Therefore, without denying the specificity of natural limits to growth in an industrial global capitalist economy, it is clear that the problem is common to all civilizations since the dawn of agriculture. At issue is nothing less than our species relation with the rest of nature. But limits to growth does not provide us with a philosophy of nature or anything about who we are, where we come from and where we are going. Thus, Limits to Growth of the Club of Rome, if taken as a paradigm, may offer a technical approach to nature as provider of “resources" and “services” but not an ethical perspective for a good society.

For all who argue for a scaled back “sustainable” communal human society, the key question is how scaled back and what such sustainability entails for the lives of other species? Would that be defined simply by technical requirements to maintain a sustainable stock of other species and some balance in ecosystems to meet our needs for food, shelter, and fun or by adhering to a philosophy of nature that affords similar rights to all species to live their full natural potential?

In Economics, Socialism and Ecology, Part 2, I have argued that the crisis we face is really a crisis of the anthropocentric civilization that has manifested itself as the crisis of the industrial capitalist system. Civilization has been built on farming that requires alienation from nature. Our species that has viewed itself an integral part of the nature and practiced ecocentric cultures for millions of years has come to institutionalize an anthropocentric culture that aims to control and dominate nature. Social alienation, manifested by social segmentation of all kinds, including through class and state formation as well as markets (especially under the capitalist system) have rested on alienation from nature. All different modes of production and social formations since the Agricultural Revolution have been built towards the goal of controlling and exploiting nature. That, of course, included exploitation of other human beings.

I submit that ecological socialism and anarchism or any other emancipatory movement should be based not on any natural, social or economic limits to growth but on a positive world movement to reintegrate ourselves with the rest of nature that includes embracing all of humanity in its many creative and enriching potentials.

Notes:

1. Saral’s essay is dated August 28, 2010 but was sent for publication in Our Place in the World a few weeks ago. The essay contains other issues that need critical discussion. However, I am focusing on the section that argues for a limits to growth cause of the Great Recession.

Notes:

1. Saral’s essay is dated August 28, 2010 but was sent for publication in Our Place in the World a few weeks ago. The essay contains other issues that need critical discussion. However, I am focusing on the section that argues for a limits to growth cause of the Great Recession.

2. There is a table on page 269 of Saral’s book The Crises of Capitalism (2012) that show these costs rise somewhat in Federal Republic of Germany during the 1970-1988 period. While this is suggestive that the same may have been happening in the U.S. it is necessary to document these and show their causal connection to the Great Recession.

3. The Club of Rome was founded in 1968 “as an informal association of independent leading personalities from politics, business and science, men and women who are long-term thinkers interested in contributing in a systemic interdisciplinary and holistic manner to a better world. The Club of Rome members share a common concern for the future of humanity and the planet.” (from Club of Rome website)

1311. Understanding the present-day World Economic Crisis: An Ecosocialist Approach

3. The Club of Rome was founded in 1968 “as an informal association of independent leading personalities from politics, business and science, men and women who are long-term thinkers interested in contributing in a systemic interdisciplinary and holistic manner to a better world. The Club of Rome members share a common concern for the future of humanity and the planet.” (from Club of Rome website)

Related posts:

9 comments:

As soon as you try to analyse resource constraints by things measured in $, you have missed the point that $ are only an abstraction - they can be conjured up out of thin air by central banks, and have been increasingly since the US broke the peg to gold in 1971, forcing the rest of the world to follow into a world of entirely fiat currencies.

The correct key factor is Energy - the stuff that obeys the incontrovertible

Laws of Thermodynamics.

The energy stuff that ran into resource constraints first was Oil. It is no

coincidence that US Peak Oil occurred in 1970, and the $ went fiat in 1971 - the US Government has been well aware of Peak Oil all along. Their "swing producer" (who would limit supply to maintain stable prices) was the Texas Railroad Commission, and they had to be on top of their game to do their job - they didn't lift all restrictions on production in 1970 by accident. Faced with the prospect of a rapidly rising oil import bill, they went fiat.

With Saudi Arabia as the world's swing producer, between 1983 and 2003 the world needed 1.6% per year growth in oil production, and it was available, so its price was stable and everyone was happy. But then in 2004 Peak Oil was fast approaching, and that 1.6% growth was not available, so the price started rising. Capitalist economists said "No worries, the market will sort it out - higher prices will bring more oil to the market", but it was physically impossible to get more oil to market in the required timeframe, at any price.

Lack of oil means lack of economic production, so by mid-2008, long before the price had risen enough to bring more oil to market, the record price of oil was breaking business models, businesses were going broke, loans were defaulting and highly leveraged banks defaulting.

On July 11th, oil set a record $147/barrel in NY in hectic trade. On close of business the FDIC announced the bankruptcy of the US's second biggest mortgage lender, and that talks were under way with Fanny Mae and Freddy Mac, which led to their "special receivership". On July 14th everything had changed - the oil price collapsed, and banks started deleveraging like it was a race to the bottom. Pop!

Dependence on credit to buy houses, cars and everything only works so long as oil production, and hence the economy, is growing. When it stagnates, there is an economic implosion.

-continued

- continued

It is far too late to plan a transition to alternative fuels, because the vast

new infrastructure required needs building first. And that means more mining, more trucks to cart the ore, more chemicals to process the ore, more smelters, and all of those mean more energy. And all the time ore grades are decreasing, meaning even more useless rock being quarried and trucked, more grinding of the rock to expose the smaller crystals of ore, more acids to leach the ore out, more alkalis to neutralise the waste. It's not a linear relationship - the energy requirement per unit of output is highly exponential, and it forms an

energy barrier to development.

It is certainly possible to begin a transition to renewables energy sources, but it is impossible to complete it, whatever political system you choose.

That won't stop politicians of every hue claiming THEY have the policies to

bring prosperity back, and no doubt people will elect them, but it won't work because it CANNOT work. There will be revolutions against austerity, but that won't help either.

The energy baseline is the sunlight which falls on the planet, and that is a huge quantity of energy. But to build something to intercept that energy and

concentrate it into something like electricity, on any planetary scale is

impossible now that we have wasted the resources we had. So the planet is

over-populated with high energy consumers, and the population must fall back to baseline balance (very roughly 1.5 billion people). Unfortunately there will also be population under-shoot, as any textbook on ecology will tell you. Vast areas of the planet will be effectively uninhabitable for humans. The only surviving lifestyles will be like those that have failed to join the modern world today - rainforest hunter-gatherers living in huts made of local materials, like it was meant to be.

Dear Kamran,

I have not been able to post my comments here because they are too long (I have posted them on the google group)! If you think it worthwhile I can shorten them and re-post. Or you can do it and run it past me!

Jonathan

Hi David,

In the spirit of comradely discussion, I wanted to make some comments that challenge some of your statements, in order to, I think, develop a more fair understanding of Kamran Nayeri’s article, which shares in the understanding that ecology is too often treated as something ‘outside’ of our affairs, even in the ‘economy,’ but develops some criticisms of parts of the theoretical framework that Saral Sakar assumes in arguing that what is at the root of the current economic crisis is a secular rise in the real cost of production of oil, which reflects inherent limits to growth of a society organized by the accumulation of capital in a world of ultimately finite resources and material capacities. The comments are organized into three chunks, and I try to be brief in what is an extremely complex discussion, which I hope might get more clarity here.

First, the comment seems to deny any reality to money, and yet at the same time appeal to rising oil prices (here, unadjusted for inflation) as the cause for the current economic and overall ecological crisis. So, which is the case? Is money "fiat" or is it a store of value, means of exchange and generalized commodity, in a world capitalist economy where everything is a commodity more things are becoming commodified? Apparently, because of reference to "energy" being the sort of invariable measure, money must be real.

Second, the talk about energy is to make oil special, which in a sense it is. Oil is a component in the production of most, if not all commodities. The uneven distribution of oil as a natural resource across the globe does today have political implications. But what does determine the price of oil? What theory can be proposed in order to explain this? Much has been talked about in terms of OPEC being the major player in setting, not taking from the market, oil prices. In principle, we cannot confuse changes in oil prices with all kinds of other events as a unidirectional cause for the event. But everybody knows that very often outside events, like political instability, raises the price of oil.

Finally, is rising price of oil the fundamental cause for the Great Recession? I didn’t see attention in the comment to the, I think, serious methodological problems of Saral's explanation for the Great Recession. No data, no references to the literature for supportive evidence, no statistical analysis establishing causality has been given. Hence, I don’t see proof that oil or any other commodity prices caused the Great Recession.

I think that in the final analysis, an ecosocialist revision of radical political economics requires value theory. This component of Marxist political economy is I think still vital and whatever revisions we need to make in order to make radical social science more materialist, more “real,” in grasping society and nature as an organic system, still has to maintain that the capitalist mode of production does organize the social reproduction of everyday life. To understand the particular question of the current crisis with categories given its “object,” the use of Marxian categories is I think entirely appropriate, as Kamran has referenced a number of serious works in radical political economics that has done that in recent years. But I am open to alternative frameworks with the theory and data that is required to consider it as scientifically as possible.

Sincerely,

Robin

Dear Kamran,

You clearly summarise Saral's core contention, which is that the limit to growth was the most important deep cause (there were other factors of course) of the global recession. Specifically, Saral argues that the only way to explain why sub-prime mortgage lenders defaulted on their loans was that rising resource costs led to increases in the ‘cost of living’ and reduced disposable income. This impacted on mortgage holder’s ability to service loans leading to default and triggering the financial fall out, and subsequent recession.

You say that Saral provides no 'time series data to support his claim for a secular rise in primary commodity prices.' This is true, and I would like to see some more specific evidence on the relationship between mortgage defaults and costs of living pressures.

But Saral does provide the following evidence:

The contraction of the resource base of industrial societies is most clearly manifested in the fact that oil extraction has, according to most experts, peaked or even crossed the peak. That is why the price of crude oil, by far the most important resource of modern industrial societies, had been rising continuously in the few years before the present crisis broke out. In July 2008, it reached over $140 per barrel. Also the price of other important resources – the energy resources coal, gas and uranium as well as industrial metals like copper, zinc, iron and steel, tantalum etc. – rose sharply. Even the prices of foodstuffs, for hundreds of millions of people all over the world the main source of energy for recreating their labor power, rose exorbitantly. After the recession began and deepened, the prices of these resources fell again, but they never reached the low level in which they were, say, in 2000. Today, in July 2010, despite the fact that the recovery from the recession is very slow, crude oil price is fluctuating around $80.'

As far as I can tell these facts are basically correct. There was a sharp rise in resource prices prior to the global recession and, even today, they have not returned to pre 2000 levels. This is certainly true for oil, which remains expensive, even after the much-hyped shale oil/gas boom in the United States. As Dr Richar Miller, former BP geologist said here:

"The oil price has risen almost continuously since 2004 to date, starting at $30. There was a great spike to $150 and then a collapse in 2008/2009, but it has since climbed to $110 and held there.

Additional oil has been supplied but it is the form of unconventional expensive oil. Oil is a unique commodity because it is the life-blood of industrial society and therefore the increase expense flows through to the entire economy. Because it is so vital for so many industries, it cuts into the disposable incomes of everyone across the economy. In simple terms more income/savings have to be devoted to attaining energy, meaning less income/savings to devote to other purposes.

But it is not just oil. Resource prices, across the board have risen sharply since 2000s. My evidence comes from the impeccable sources provided by the transnational elite i.e the World Bank, IMF, World Economic Forum etc etc. Check out the graph on page 13 of the Circular Economy Report produced by the WEF. The graph is based on an index of average resource prices including, energy, agricultural and metals. It shows that since the 2000s prices have shot up to the point where they have, in the words of the report, ‘essentially erased a century’s worth of real price declines.’ Though prices have dropped since the recession, they remain very high compared to 20th century levels. Contrary to what you contend, the spike on that graph certainly does not look like a ‘cyclical’ phenomena! What can explain this?

To be continued in a second post below….

You argue that it was simply due to rising demand in India and China etc. But this is an inadequate explanation for reasons that were actually very well articulated by Saral in his original essay:

These price rises are also not being caused only by rising demand from China, India, Brazil etc. If this were the only cause, a corresponding increase in supply by the corporations of the respective branches of the mining industry could stop the inflation soon. No, the main cause of the said price rises is the rise in the extraction costs of the most important raw materials. These cost rises are being caused by the fact that the raw materials in question must increasingly be extracted in geographical and geological regions and layers of the earth which are getting more and more difficult to access (think of extraction of oil from the bottom of the frozen sea at the West coast of Greenland!). For such extraction activities, necessarily, more and more energy and material input is being made. In the case of extraction of energy raw materials, what is most decisive is the energy balance, i.e. the net energy made available at the end of the process. We humans cannot change the geographical and geological conditions. (for elaboration of this point, see Sarkar 1999, chapter 4, and Kern 2010)

This is correct. If supply were no problem then the rising price of oil, which also feeds into the cost of extracting other resources, would have been met by additional supply. It hasn’t been; or at least not cheap supply. We have seen the boom in ‘unconventional’ shale oil/gas and tar sands etc. But these energy sources are expensive and have not returned oil prices back pre 2000 levels. In other words, oil may not have peaked, but the age of cheap oil is over. There is also very good indication, as pointed to by Dave Kimble and Afheez Ahmed here, that the present unconventional oil/gas bonanza will be short lived.

So I think the evidence suggests that critical resource costs remain high. Why would this not have been a crucial factor contributing to the global recession?

It was not, of course, the only factor. You are right to point to the value of Marxist theories in helping us make sense of the crises. By the way, I found this account by the Marxist William Robinson’s very clear and helpful. (For readers of this google-group short on time see this excellent animation featuring David Harvey here). These accounts explain the crisis, as you correctly note, in terms of long-term stagnating real wages, leading to rising consumer/government debt. This then fed into the perpetual ‘crisis of accumulation’ as reduced demand meant capital struggled to find outlets for profitable investment. Most investors found it (and still do) more profitable to speculate (i.e gamble) in stocks and derivatives etc than invest in the real economy. Hence the phenomenon of ‘financialisation’ and an outrageous situation in which 40% of U.S profits are made in the finance sector. And then, of course, the inevitable bust as the comical (if it were not so tragic and costly) ponzi scheme comes crashing down.

But in his essay Saral made an important observation. This was not the usual financial boom and bust, of previous capitalist crises. It was triggered by a default on home-loans. But houses, unlike other commodities, tend to be in stable demand. As Saral says ‘there is no dearth of demand for them because almost all over the world population is growing and people are desiring better housing.’ So this raises the question: why did people, on mass, default on their home-loans? For that, I think Saral very plausibly points to the rising resource costs imposed on the economy.

To be continued in a third post below….!

I do not; therefore think these are mutually exclusive or contradictory accounts. Much of Saral’s latest book discusses the Marxists themes you mention in detail (i.e tendency of profit to fall, crises of accumulation etc). He would not disagree that these factors are important in explaining recurrent capitalist crises. But he argues, plausibly I believe, that this crisis was novel: it marked the beginning of the new era of growing limits and resource scarcity.

At one point you discuss the crisis in the 1970s. This is good because during the 1970s crisis many similar factors were playing out as now, although in different ways. In the early 1970s, the OPEC crisis imposed inflationary pressure on OECD economies. This was not of course, a result of geological oil limits but the political impact of cartels. But, like the current crisis, there were also crucial political-economic factors. You ask whether the crises in the 1970s were caused by high wages? I think, in part, it was. Let me explain. In the early 1970s, due to high unionization levels and conditions of full employment, workers were able to win wage increases higher than the rate of productivity growth (i.e labour output per hour). However unlike in previous times, in the 1970s, as Takis Fotopoulos points out (see his book ‘Towards an Inclusive Democracy’), capitalists could no longer easily pass on these wage costs to the consumer. This was because of the internationalisation of the economy (which had been advancing the previous two decades), which had imposed conditions of intense competition. This resulted in a profit squeeze (i.e. across OECD from 1968-73 business profits fell by 15%;). So the inflationary effects of OPEC were combined with a profit squeeze on business, which led to the phenomena known as ‘stagflation’. This was, in large part, the stimulus for the whole neo-liberal restructure, which, basically aimed at restoring the conditions of profitability in an intensely competitive international economy.

In the present crisis we do not have ‘high wages’ but rather the opposite: stagnant wages, leading to crisis of over-production/under-consumption. But like the OPEC crisis we also have rising resource costs. Except, this time, like Saral, I believe the causes are geological and therefore permanent…

I think Saral’s thesis has been further evidenced in recent times. The global economy is struggling to recover. And in recent years we have seen mass protests, riots and civil unrests in many countries. These cannot, I believe, be purely explained in political/social terms. In a recent article here, Nafeez Ahmed plausibly links rising food and energy prices to the growing inflation and therefore poverty experienced in countries such as Ukraine and Thailand, which, as we know, are currently experiencing civil unrest. Very significantly the author cites evidence from the FAO food price index, which has more than doubled from 91.1 in 2000 to an average of 209.8 in 2013. Food prices were also crucial factor behind the ‘Arab Spring’. All these trends are exacerbated by high population growth. Again, these are not the only factors. These events are obviously the result of a complex mix of political, economic and environmental factors. But I believe the environmental/resource pressures are playing a critical causal role.

To be continued in a fourth post below….!

Your critique of some limits to growth theorists, particularly in terms of the inadequate solutions they typically put forward, I agree with. As you know I support the ‘eco-socialist’ programme advanced (in slightly different ways) by thinkers such as Saral Sarkar and Ted Trainer.

In your final paragraph you say: ‘I submit that ecological socialism and anarchism or any other emancipatory movement should be based not on any natural, social or economic limits to growth but on a positive world movement to reintegrate ourselves with the rest of nature that includes embracing all of humanity in its many creative and enriching potentials.’

I find this a strange statement. To me, the limits to growth are a harsh/unpleasant scientific reality, which we ignore at our peril. Unfortunately, in my experience, very few leftists have integrated limits into their thinking – or have done so inadequately. Of course I agree we must stress our positive vision based on alternative ecological cultures. But the limit to growth analysis shows why a realistic vision, consistent with a fair/equitable world, must be centred on a radically simpler, largely de-industrialised, way of life. I will leave aside the vexed question of ‘how we get there.’ Gladly, a more localised world-order would provide the best material basis for humanity to re-connect with the natural world. We will all be acutely aware of our dependence on our local bioregion, so we better manage it sensibly, or else we will probably regret it!

Sorry for long post but I thought the issues important. Thanks for discussion.

Kind Regards,

Jonathan

Kamran,

Unfortunately all my links fell out while doing those comments. They are important for readers to check the claims I am making. I don't have time to redo them. Any readers can ask me for links if they want.

Jonathan

Post a Comment