By Steven Davidoff, The New York Times, January 14, 2014

“The next step is to organize the shareholders.” Ralph Nader, the consumer advocate, was on the phone, outlining to me his latest cause: plunging into capitalism’s muddy waters and fighting for shareholder rights.

My interest in Mr. Nader’s latest cause was touched off by his recent criticism of the attempt by John Malone’s Liberty Media to buy the 47 percent interest it did not already own in Sirius XM, the satellite radio operator. In a statement this month, Mr. Nader asserted that “John Malone’s offer to buy out Sirius XM’s shareholders at $3.68 a share is ludicrous.” He then went on to call on the activist investor Carl C. Icahn to intervene, saying Mr. Icahn should “take notice and interest.”

Mr. Nader’s latest drive comes on the heels of his repeated protests about the federal government’s treatment of Fannie Mae and Freddie Mac shareholders and a successful campaign to get Cisco Systems to increase its dividend.

So what gives? How can Mr. Icahn and Mr. Nader, a person who has described himself as an “adversary of corporate capitalism,” find themselves on the same side?

I called Mr. Nader to find out the real story. Within a few hours, I had the 79-year-old legend on the line.

Mr. Nader said he saw his shareholder rights activity as a natural extension of his work. Right now, “it is very hard to find entry points” to influence corporate America, he said, because “deregulation is rampant” and access to the courts has declined as shareholder suits have been limited and the courts have increasingly endorsed the ability of corporations to push consumers into arbitration. Adding to that, “congressional oversight is weak,” he said, and “prosecution budgets are very low.”

That Mr. Nader is frustrated with the state of America is nothing new. For almost 50 years, he has pushed for progressive and liberal causes, and he said he saw his latest cause as continuing his work in trying to tame corporations. As Mr. Nader sees it, “shareholders are experiencing a similar diminution” in rights as the average American. He cited the example of Mark Zuckerberg and how his voting control of Facebook weakened the rights of other shareholders.

Mr. Nader said that shareholder empowerment was the only way he saw to take control of companies from executives and boards, a group that he perceives as only looking out for themselves.

Mr. Nader is not advocating the social type of shareholder activism that was started by groups like the Sisters of St. Francis of Philadelphia. The nuns in the order have been pushing social causes as shareholders for more than three decades, and have brought anti-fracking resolutions at Exxon and challenged Walmart to stop selling adult videos, in the name of social responsibility and morality.

Instead, Mr. Nader sounds like any Wall Street banker who has a deep knowledge of corporate history and is concerned about shareholder returns.

Ask Mr. Nader about Sirius, and he talks for 10 minutes about its financial state and why Mr. Malone’s bid is undervalued. He calls Mr. Malone a “buccaneer” who is smart and has made a lot of money. He considers Mr. Malone’s bid for Sirius opportunistic and sees “Sirius stock really moving into a growth pattern” because it is “paying down more debt.” Referring to the company’s price to earnings ratio, he says Sirius is “moving into a decent p/e due to recent dividend payments.” Mr. Malone, he adds, is coming in with the stock unusually low — it was $3.68 on Monday — and that “this thing could go to 6, 8, 10 dollars per share.” Mr. Malone’s bid, Mr. Nader goes on, is just like Mr. Icahn’s bid in the 1980s for TWA, back when Mr. Icahn was known as a corporate raider.

Liberty Media said in an emailed response, “We are confident that as the special committee and the minority shareholders focus on this offer and look at the long-term track record and performance of Liberty that they will see the significant benefits of this proposed transaction.”

As for Cisco, Mr. Nader focused on the company’s $43 billion cash pile. He recalled how he gathered the shareholders and “launched a campaign to get other shareholders.” He recruited 22 to 23 shareholders and, together, informed Cisco’s management that they were “sick and tired” of the cash hoard. Mr. Nader went on to talk about why stock buybacks are not appropriate and how he prefers a dividend to discipline management, a view that many investors and scholars would wholeheartedly agree with.

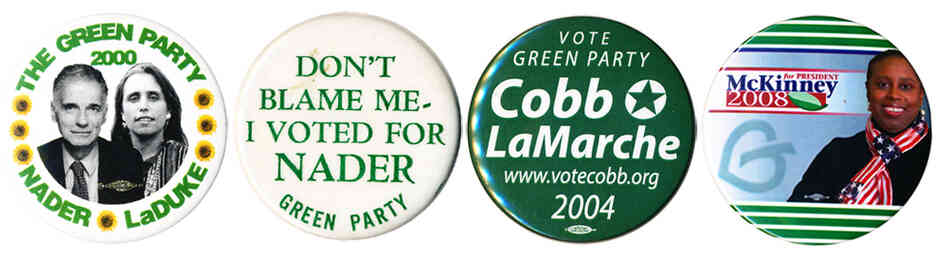

Mr. Nader came to renown as the author of the 1965 book, “Unsafe at Any Speed,” about the American auto industry’s emphasis on style and profit at the expense of safety. But the anticapitalist also seems to be a good investor — with a portfolio he valued at about $3 million a few years ago. He has earned millions of dollars in royalties, speeches, interest income and writing and television fees, he told The Washington Post in 2000, as he was about to run for president as the Green Party candidate, though he said he gives away much of his income.

The common theme in Mr. Nader’s shareholder activism is that he personally owns the shares. In Sirius’s case, he bought shares early for as little as 60 cents a share, and he owned 18,000 shares of Cisco when he started his dividend campaign. When I asked him about his returns and whether he had an eye for investing, he laughed and said that he did not because he “invested in solar energy stocks,” and they were crushed by a glut of Chinese panels.

But Mr. Nader has laid out a campaign to move forward beyond his investments. He said he saw the disorganized nature of shareholders as the first problem and wanted to “collect the leading shareholder advocates to try and get them together to get a shareholder action group operating.” Mr. Nader said he hoped to turn the capital markets from an “exit system,” where the only remedy was to sell, into a “voice” system, where shareholders have a say.

Mr. Nader cited the famous Berle-Means hypothesis from 1932, which says that shareholders’ representatives — the company directors — are too independent of shareholders and have virtually free rein. The result, Mr. Nader said, is “recklessness and risk taking by corporate management.” He suggested a three-step process to address this: control salaries, control dividends and improve disclosure.

Mr. Nader’s agenda is the same as hedge fund activists’. They are trying to tame the corporation. The campaign by David Einhorn’s Greenlight Capital and Mr. Icahn to get Apple to distribute its cash hoard is no different from what Mr. Nader advocated at Cisco. Curbing excessive executive compensation is a full-time shareholder pursuit these days.

Even the goal is the same. Mr. Nader is also out to seek a better return. What is different is that Mr. Nader sees a further goal. He argues that executives are taking excessive risks in the name of profit. By controlling them, he says, corporations will act more socially conscious. And in the end, he says, this will make money.

Mr. Nader is in the right field right now as shareholders try increasingly to take control of companies. The issue, as Mr. Nader acknowledged, is organizing this diverse group and getting them to speak as one. “Once you awaken shareholders,” he said, this “will involve that the more civic values will be incorporated into society.” Will this happen?

I’m skeptical, because I think that bringing together the mutual funds and the pension and hedge funds will result in too many different agendas, let alone agreement on Mr. Nader’s goals. But it is intriguing that Mr. Nader, the man who at one point was General Motors’ greatest foe, is now so aligned with many of the forces of Wall Street who are pushing for more shareholder control.

I asked Mr. Nader whether he would continue to aim at corporations and, if so, which one. He laughed again, said that Monsanto would be a good one, and hung up.

No comments:

Post a Comment