Only those who most stubbornly hold fast to their ideological blinders would today deny that there is a link between capitalism and emissions of carbon dioxide. The latter have grown in tandem with the former, not coincidentally but constitutively. But it was not always like that. Originally — and this holds however one wishes to date the birth of this mode of production: to the fourteenth, sixteenth, or late eighteenth century — capitalism relied on what would today be called renewable energies: wood, muscle, wind, and water. It then adopted fossil fuels, coal first of all. By this step — surely one of the most fateful in its history — capitalism sired a peculiar formation I describe as the fossil economy, most simply defined as an economy of self-sustaining growth predicated on the consumption of fossil fuels, and therefore generating a sustained growth in CO2 emissions.1 Picture a pair of bellows. If one of the handles is the ceaseless growth that defines capitalism, the other is made up of coal and oil and gas; out of the nozzle comes a blast of CO2 that fans the flames of the fire of global warming. The more growth you have, the more forceful the push will be, and the stronger the blast.

This observation, however, does not solve the question of how exactly capitalist growth has been linked to fossil fuel consumption over the course of its history; it merely poses it. The easiest way to describe the correlation of the two would be to conceive of capitalism as a smooth, linear curve of perpetual expansion, emitting a stream of CO2 just as steadily enlarged. But this would be inaccurate. Capitalist growth is a singularly turbulent process. It moves in spurts and slowdowns, creates and destroys, accelerates and decelerates, clears the ground of established structures for the building of higher stages and tumbles, without fail, into depressions.2 To be sure, growth as such rarely ceases; rather it sticks to a secular trend, the many deviations and fluctuations moving around an upward curve.3 But the process of growth proceeds through upsetting contradictions rather than an even, incremental addition of output, which impel the expansion and renew the momentum again and again, and it might be these contradictions and the convulsions they generate that do most to produce and reproduce the fossil economy on ever greater scales. The dents in the curve may hold the secrets to its direction.

The Energy in the Waves

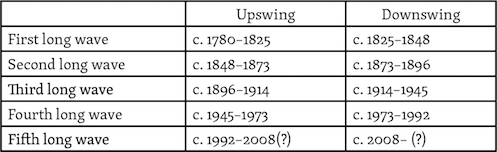

One way of conceptualizing this history of dynamic non-equilibrium, which seems to have a promising but surprisingly overlooked potential for our purposes, is the theory of long waves of capitalist development. Commonly traced to the foundational contribution of Russian economist Nikolai Kondratieff in the early 1920s, the theory proposes that capitalism moves in waves of forty to sixty years’ duration.4 Each wave has two phases: an “upswing” characterized by boom conditions, succeeded by a “downswing” of persistent stagnation. The exact periodization has been a matter of endless controversy, but a standard chronology would look something like this:

Figure 1. Waves of Capitalist Development

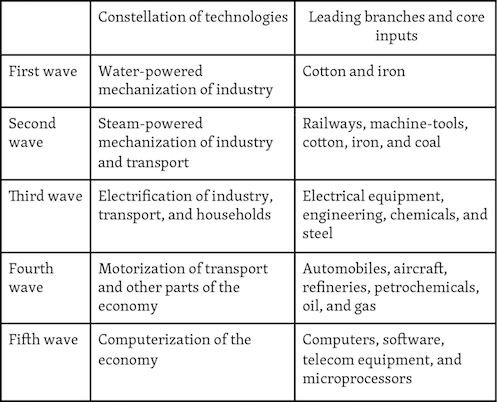

When Kondratieff first proposed the wave movement, he claimed to have discovered it through sheer observation: no economic theory predicted such a rhythm to growth.6 Ever since, the most compelling argument for the existence of long waves has been empirical.7Few economic historians would dispute that growth in the advanced capitalist countries has generally been faster in the periods designated as upswings and slower in the downswings: some sort of alternation appears undeniable.8 But why would capitalist economies develop in this jerky fashion? One part of the answer, on which most theories of long waves build, is the rhythm of technology diffusion. Truly revolutionary technologies, with the power to electrify economies both literally and figuratively, change the way goods are produced and open up fresh venues for general expansion, do not come online gradually. They come in bundles and bursts and thrive on dislocation; only if a crisis has weakened previous technological systems can they break through and advance.9 Each wave is consequently associated with a certain set of technologies, and the consensus as to their identities is wide and well-supported.10 A typical list would look like this:11

Figure 2. Associated Technologies

Two things strike the eye here. First, the emergence of the fossil economy appears to have occurred in the shift from the first to the second long wave: from one based on water to one picking up steam. This is the conjuncture where it all began.12 Second, each subsequent wave — with the curious exception of the fifth — seems to have surged forward on the basis of technologies producing or transmitting fossil energy in novel ways. Students of long waves have not failed to notice this pattern. “In each wave dominant technologies can be identified that are associated with primary energy sources such as coal, oil, and natural gas,” states one; Kondratieff himself saw one of the clearest signs of an upswing in “the rapidity in the increase of coal production and coal consumption”; in a short paper inspired by the oil crisis of the early 1980s, George F. Ray argued that major innovations sparking off long waves were “either directly originating in, or closely connected with, the production of energy, such as steam engines or the railways,” always boosting the demand for energy, always dependent on “the abundant supply and almost unlimited availability of fuel.”13 The implication of this statement is significant: capitalism has moved out of its recurring downswings and revived growth on a higher level, first by starting, then by stoking and augmenting the fire. Picture the pair of bellows being blown every fifty years or so, each time with greater force, each time generating a new pulse of CO2 that rises towards the sky for the full duration of capitalism and, most likely, beyond.

At first sight, the fifth wave is anomalous. Computers are one step removed from fossil energy, at least when compared to steam engines or automobiles, and yet the wave which their generalization appears to drive has generated the most extreme explosion in global CO2 emissions ever recorded. I will return to this apparent paradox below. It seems, however, that, following the original switch, every downswing has been overcome through a deepening of what is often called “carbon lock-in.” The alloy of fossil fuels and self-sustaining growth has been consolidated in three consecutive revivals (late nineteenth century, mid-twentieth century, late twentieth century), which reconfirm combustion as the venue for expansion and suffuse the economy with coal, oil and natural gas on a progressively larger scale. In the process, each wave has also produced its own “technomass,” to speak with Alf Hornborg: an infrastructure of the (for the moment) most advanced technologies, as in railroads, electrical grids, highways, oil platforms, tankers, airports, data centers… the ever-growing bag between the handles, as it were.14

Some fossil technomass is flushed away by subsequent waves — Joseph Schumpeter’s famous “creative destruction” — and deposited in the earth’s crust. Some is incorporated by the new eras. Old railroads, electrical grids, highways, and other infrastructures still in use can be seen as material legacies from previous long waves, the body of the fossil economy swelling and solidifying throughout its history; they represent technologies bequeathed to the present.15 No wave has, as yet, displaced any fossil fuel; coal has been a mainstay since the second.16 Urban sprawl is an inheritance from the end of the third and onset of the fourth.17 Coal mines and airports currently under construction to connect the nodes of globalized production will weigh down on future generations: and so on. The history of the fossil economy takes the concrete form of a sedimentation of layers upon layers — not through gradual accretion, but through successive alluvial deposits from discontinuous, often violent long waves.

Carlota Perez, the most influential wave theorist of the early twenty-first century, who stands on the shoulders of Schumpeter, writes:

So each great surge [her preferred term for waves] represents another stage in the deepening of capitalism in people’s lives and in its expansion across the globe. Each revolution incorporates new aspects of life and of production activities into the market mechanism; each surge widens the group of countries that conforms [sic] the advanced core of the system and each stretches the penetration of capitalism to further corners of the world, inside and across countries.18

Exactly the same thing could be said about the fossil economy, because it has been at one with capitalism. The long waves have been capitalist and fossil bound, diffusing new combustive technologies without which business-as-usual would still be stuck in the steam age. Each upswing has been punctured by a signal crisis, marking the arrival of a structural crisis of the capitalist economy, resolved — so it seems — by the adoption of innovative fossil fuel-based technologies across the board, until the globe as whole resembles a bag in the bellows. Why? By what fossil mechanism has capitalism leapt from wave to higher wave? To be able to search for answers to these questions, I need to engage more closely with some theory of long waves. Among the very many proposed since the days of Kondratieff, I select one, nowadays virtually forgotten, that of Ernest Mandel.

A Dialectic of Profits and Prime Movers

A revolutionary Marxist and leader of the Fourth International, Ernest Mandel pioneered the resurgence of scientific interest in long waves from the 1970s onwards. His own idiosyncratic theory was first outlined in Late Capitalism (1972) and then elaborated in Long Waves of Capitalist Development: A Marxist Interpretation (1995).19 Long waves, in Mandel’s definition, are a cycle of “successive acceleration and deceleration” of capital accumulation.20 Given that such accumulation originates in the production and realization of commodities, upswings will manifest themselves in high rates of growth in industrial output and world trade and downswings in a slackening of both, a rhythm Mandel claimed to be able to demonstrate with statistics.21 Contractions do not vanish in the upswing, but are relatively short and mild, while years of feverish prosperity predominate; conversely, fleeting booms are interspersed between the long and severe recessions characteristic of the downswing.22

For Mandel, however, long waves are not only or even primarily statistical phenomena. They are real segments of capitalist history. On this point, he took a leaf from his maestro Leon Trotsky, who censured Kondratieff in the early 1920s for imputing a law-like regularity to the waves, modeled on the shorter business cycle. No ticking clocks automatically set off upswings and downswings, Trotsky argued; instead, the turning points between the phases are determined by such unforeseeable events as wars and revolutions, the colonization of new countries, or the discovery of new resources — “those external conditions through whose channel capitalist development flows.”23 Moreover, the two phases correspond to “entire epochs,” in economics but just as much “in politics, in law, in philosophy, in poetry [!]”: “in all spheres of social life.”24 They are qualitative totalities, not quantitative artifacts, to be studied in all their complexity and, as one would say today, contingency.25

Writing on the other side of one full wave, Mandel could add new material to Trotsky’s picture. The first upswing coincided with the French Revolution and the Napoleonic Wars; the second with the heydays of free competition and Victorian progress; the third with classic imperialism and finance capital; the fourth with the golden era of mass production, Keynesianism, consumerism, the welfare state; to which one can now easily append neoliberalism, globalization, bourgeois triumphalism, “end of history,” network society, digitalization, and all the other trappings of the fifth.26 In between lay no less distinctive periods of social upheaval and strife. Others have made similar observations, among them Eric Hobsbawm:

Each of the “Kondratievs” [sic] of the past not only formed a period in strictly economic terms, but also — not unnaturally — had political characteristics which distinguished it fairly clearly from its predecessor and its successor, in terms both of international politics and of the domestic politics of various countries and regions of the globe. That is also likely to continue.27

It follows that the waves cannot be perfectly symmetrical oscillations of the same length.28Since they move “in zigzags, looping up and down,” with Trotsky; shaped not by any single factor but “by a series of social changes,” with Mandel; playing out on “the social, political and cultural scenes,” with Hobsbawm, there is no reason to expect any fixed periodicity.29 To this argument, however, Kondratieff presented a powerful rejoinder. If the waves are conditioned by random shocks — wars, revolutions, conquests, discoveries — why would there be any discernible sequence to capitalist development? Why would such events cluster around the turning-points — think of the revolutions of 1848, the outbreak of World War I in 1914, the oil crisis in 1973, the final collapse of the Soviet Union in 1991 — if not because they are symptoms of the waves, rather than their causes?30 Accidents make for bad pacemakers. Trotsky never offered a reply, leaving it to Mandel to try to fuse the two views: long waves are indeed epochs bound by political struggles (Trotsky), but they are also the products of endogenous tendencies in capital accumulation (Kondratieff).31 How could that possibly be true?

To solve this theoretical conundrum, Mandel introduced the concept of “partially independent variables” acting upon the capitalist laws of motion.32 Put in the simplest possible terms: suppose inventors have developed a major new technology, lying in wait in workshops until massive investment will diffuse it. Suppose capitalists remain hesitant, because the expected profits are too low to merit the outlays — then all of this falls within the modus operandi internal to the mode of production itself. Now suppose that the main trade unions suddenly fall apart. A piece of anti-union legislation may have been rammed through; ideological infighting, choked funding, or military occupation might have caused the unions — hitherto mighty enough to block all wage cuts — to crumble. None of these factors can be derived from any intrinsic logic of capital. As a result, the profit expectations receive a shot in the arm, capitalists rush to invest in the new technology, and soon a full upswing is underway. In Mandel’s theory, this would be a perfect case of how “partially independent variables” — here, the change in union power — interact with the systemic laws of motion, first holding accumulation back and then letting it loose as the historical stage is rearranged. In itself, such an event cannot open up a new epoch, but if it is combined with trends growing out of the system itself — and this is what happens at the turning points — all the components might fall into place for a step change.33

The accumulation of capital has certain inbuilt tendencies — to maximize profits, to ratchet up the rate of exploitation of labor, to raise the productivity in the struggle against competitors, as well as to search for improved technologies, larger markets, cheaper raw materials, and so on — that give the capitalist mode of production its general “push.”34But these tendencies never operate alone in the world. Capital confronts an environment where foreign and often volatile influences are at work: classes with varying degrees of capacity to advance their interests, states with shifting alliances and geopolitical ambitions, ideological traditions with long lifetimes and irregular breaks, remains of feudalism or actually existing socialism or the welfare state, all with their own forces of gravity.35 Such variables, and the list could be extended endlessly, are partially independent or autonomous, in the sense that they have roots in historical soils not endemic to capital itself, yet cannot fail to be entangled with capital in a world dominated by it.36 These variables are not fully inside capital, but not fully outside it either. Capitalist laws of motion therefore assert themselves through an interaction between intra-economic and extra-economic forces, and it is here, in the “concrete dialectic of the subjective and objective factors,” that the long waves arise, their epochal essences being, so to speak, amalgamations of innumerable variables with a certain temporal solidity, eventually cracked by new contradictions.37

There is reason to ask if this amounts to a theoretical solution. Is it anything more than a blank check for analytical eclecticism? What else does it achieve than reformulating the Trotsky/Kondratieff antinomy on a higher level?38 A Mandelian response might be that no formulation, however subtle and intricate, can reflect the real jumble of causal pathways between the mechanisms of capital accumulation and their “external conditions”: only historical inquiry can disentangle it.39 For such an endeavor, Mandel put up certain signposts. First of all, he urged close attentiveness to ups and downs in the rate of profit, the safest indicator of how well the accumulation of capital fares. Since the production of commodities is motivated by the quest for profit, it will grow fast and slow as profits rise and fall; in times of declining profitability, capitalists will be less inclined to invest, and vice versa.40 As new technologies are introduced in an early upswing, avant-garde investors who avail themselves of the higher productivity will reap super-profits exceeding the average and pulling it up in the process.41 Further into the upswing, however, clouds will sooner or later gather on the horizon, in the shape of any number of contradictions: too much installed machinery might turn into a burden; too many factories might have been built for the market to absorb the output; full employment might inflate the power of the unions; high demand might drive up raw materials prices — with any amount of input from the partially independent variables.42

Whatever the exact nature of these contradictions, they will feed into the rate of profit and lower it. Be it expensive machines, dried-up markets, militant labor, expensive fuels, or any other affliction, the capitalists will experience it as a downward pressure on the rate of profit. Here is the “synthetic index of the system’s overall performance,” the “seismograph of history” recording and expressing “all the changes to which capital is permanently subject”: the single point in which endogenous and exogenous factors converge.43 It is also the most important measure for practicing capitalists — that which “makes the system tick.”44 Consequently, a declining rate of profit will announce the approaching terminus of the upswing; the signal crisis might see it in free fall; throughout the early downswing, it will stay flat or even fall further. “Only when specific conditions permit a steep rise in the average rate of profit” will capitalists regain their appetite for investment and, if all goes well, launch a new upswing.45 The moment of steep rise registers the (if only temporary) resolution of the contradictions: afflictions eliminated, profits spike. In other words, movements in the rate of profit set the rhythm of deceleration and acceleration by summing up the general conditions and regulating the motivations for capital accumulation.46

No upswing can transpire, however, Mandel argues, unless any working-class resistance threatening to smother profits is defeated. The eruption of a structural crisis is usually attended by high unemployment, deflation or inflation, deteriorating working conditions, aggressive wage-cuts as capital seeks to dump the costs on labor and widen profit margins — all conducive to intensified class struggle. Integral to the brew of the downswing, the contest between the classes is an inherently unpredictable component. Here, more than anywhere else, “subjective factors” come into play: the organizational strength of the working class, the degree of its self-confidence and autonomy, its militancy or propensity to compromise and the equivalent factors in the camp of the bourgeoisie determine the outcome.47 Capital can lay the foundations for a new epoch of expansion only if it prevails against all enemies and social impediments, including, but not limited to, organized labor.48 How does such a victory materialize? What does capital do when it triumphs? It starts a technological revolution, concentrated to one particular sphere. Mandel explains it this way in Late Capitalism:

In order completely to reorganize the technical process new machines are needed, which must previously have been designed.… [Q]ualitative leaps forward are necessary in the organization of labor and forms of energy…. The fundamental revolutions in power technology — the technology of the production of motive machines by machines — thus appears as the determinant moment in revolutions of technology as a whole. Machine production of steam-driven motors since 1848; machine production of electric and combustion motors since the 90s of the 19th century; machine production of electronic and nuclear-powered apparatuses since the 40s of the 20th century — these are the three general revolutions in technology engendered by the capitalist mode of production since the “original” industrial revolution of the later 18th century.49

If each wave marks a new phase in capital’s capacity to recover profits after crisis, the magnitude and structure of “forms of energy” relative to forms of labor are here isolated as the sine qua non of the long waves. Power technology, in other words, is the key to the upswing. “Once a revolution in the technology of productive motive machines” — or prime movers, in common parlance — “has occurred, the whole system of machines is progressively transformed.” Each of the three historical revolutions, between the first wave and the fifth, has remolded “the entire economy, including the technology of the communications and transport systems. Think, for example, of the ocean steamers.”50 If new life is to be breathed into sagging capitalism, it must come in the most basic, most universal guise: energy.51 Only power technology pervades every nook and cranny of the mode of production, impelling, conveying, lifting, hauling, heating, pumping, communicating, fetching goods of all conceivable kinds. If a rise in profits is the economic precondition for the upswing, a new generation of prime movers is its material embodiment.

But the links between profit and prime mover are more complex than that. As an economic fact if not an ideal invention, the new set of motive machines has its immediate origins in the “attempts by capital to break down growing obstacles” to a rise in the rate of profit: on the shop floor, first and foremost.52 When capital desperately seeks to restructure the labor process and put it on a more profitable footing, nothing can be more useful than a truly revolutionary power technology. It is the battering ram, the generalizable device with which capital destroys resistance and swings into renewed expansion. Victory over labor, then, does not so much precede as come about through the energy revolution, the two working hand-in-glove as the downswing nears its end.

In a two-way process so typical for Mandel’s thinking, however, the prime mover not only assists in raising profits but also spreads throughout the economy as a result of those same raised profits: a positive feedback loop, one might say, propelling capital out of its long crisis. Moreover, the new technology can sustain the momentum of the upturn only if it is powerful and pervasive enough to maintain high profits, neutralizing any threats in the short term — which, in turn, induces capital to invest deeper in it.53 In sum, the prime mover is: (1) adopted to remove barriers to higher profits, primarily those erected by labor; (2) widely diffused when and as profits increase, partly as a result of its own exploits; and (3) used for as long as possible to ride the upswing phase of the wave, stimulating accumulation on a grander scale. In all three moments, energy constitutes the material solution to the contradictions of the structural crisis. Working its first wonders in the downswing, it comes into full bloom after a positive turning point, usually precipitated by some concatenation of victories — not only on the shop floor, but on the world arena as a whole.

Any regularity of the long waves, pace Trotsky, is laid down by the constellation of prime movers and their auxiliary machines.54 Even if the activity of inventors and engineers followed a linear, continuous rhythm, capitalism would still move in jolts and jerks, because the rise of a new constellation could only be coterminous with a sharp rise in profits — always a singular event, determined by the collision of all sorts of variables, in the class struggle above all — and only permeate the economy in heavy chunks, the shift from one power technology to another an exceedingly massive undertaking.55 But the effects of the energy injection are not everlasting, of course. They seem to last somewhat longer than five years, but never as long as half a century, the span of the upswing approximating — but no more — that of a human generation. Then contradictions resurface again.

Power technology thereby forms the materialist endpoint for Mandel’s attempted fusion of endogenous laws and exogenous shocks, Kondratieff and Trotsky, accumulation and politics: a highly original sketch of a theory, identified by the author of Late Capitalism as his own special contribution to the field.56 In Long Waves, however, the theme of energy disappears from sight.57 Other wave scholars pass over it in silence. No one seems to have picked up this particular thread from Late Capitalism and followed it backwards and forwards through history; Mandel himself let it fall from his hands.58 Left to gather dust, its potentials are quite unlike those of any other long-wave theory, as will be clearer upon a brief comparison with the foremost neo-Schumpeterian version: that of Carlota Perez.

Driving the Bulldozer

“Technology is the fuel of the capitalist engine,” writes Carlota Perez.59 Mandel would have had it the other way around. True to her master Schumpeter, Perez regards technological development as a virtually unmoved mover, advancing in the workshops and laboratories of innovators, always working to improve efficiency; “once a truly superior technology is available,” its breakthrough is “practically inevitable.”60 But it demands adjustment from its surroundings. A groundbreaking innovation craves new financial systems, new governmental policies, new forms of education, habits, behaviors, “mental maps of all the social actors” matching its own logic: the computer cannot stand the rigidities of the conveyor belt or the nation state.61 It compels society to reorganize into networks. Society, however, is slow in adapting, for unlike technology, social relations are characterized by inertia, resistance, vested interests pulling the brakes, always lagging behind the latest machines.62 When new technologies appear on the scene — “received as a shock” — society is tied to the old ways.63 These must be pulverized. The period of installation

is the time when the new technologies irrupt in a maturing economy and advance like a bulldozer disrupting the established framework and articulating new industrial networks, setting up infrastructures and spreading new and superior ways of doing things.64

Like a bulldozer without a driver, technology uproots all the inadequate institutions and cart away the hurdles for its own self-realization.65 “Each technological revolution inevitably induces a paradigm shift” in society at large, forcing through rejuvenation in every sphere — from economy to mentality — in a process both necessary and painful.66At the moment of the bulldozer’s first appearance, society is rooted in the manners of obsolete technologies: a crisis of “mismatch” ensues. The whole fabric is ripped apart, until, after two or three decades, society has learned to behave as technology expects: an upswing follows.67

Since Perez’s waves — or “great surges of development,” as she likes to call them — start with the “big bang” of a revolutionary innovation, she has to turn the established chronology on its head: first comes the crisis of mismatch, then the “full expansion.”68Normally, a Kondratieff wave is understood to begin with an upswing (that is, starting in 1945) and end with a downswing (that is, until 1992), but Perez pairs the halves in the opposite order and, for instance, identifies the early 1970s as the onset of the crisis-ridden first stage of a surge induced by the coming of the computer.69 Unsurprisingly, she singles out the usual five protagonists — water-powered mechanization, steam, electricity, motorization, information and communications technologies (ICT) — but considers each the instigator of crisis, while Mandel, again, would have it the other way around: each as the creation of crisis.

In the slightly esoteric debate over how to date and define waves or surges, profoundly different views of causality are thus on display. For Perez, technology drives capitalist development; for Mandel, the reverse. Perez’s theory has its counterpart in the productive force determinism of old-school Marxists, in which social relations are motionless fetters on technology, to be burst apart by a relentless progress; for Mandel, the most mercurial substance of history is the class struggle. Social relations of power, in Mandel’s view, act as “the ultimate determination of the process of undulatory development”: the driver steers the bulldozer so that it levels his obstacles, not the other way around.70 In passing, Perez notices that a technological revolution tends to center on “a source of energy,” calling forth a novel “techno-economic paradigm” encompassing all of society — whereas in Mandel, tensions between multiple social variables usher in new energy technologies.71 While Perez essentially proposes an extension of technological determinism to the history of industrial capitalism in toto, Mandel can inspire a radically different agenda for research on the history of the fossil economy, guided by two overarching questions in necessary dialogue with each other:

(1) Have the contradictions of the downswings generated and fashioned new fossil fuel-based technologies, and if so, how? And,(2) Have those technologies served to resolve the contradictions and fuelled the upswings, and if so, how?

In wave theory á la Mandel, that which takes place in one phase is always linked to that which happened in the former. The neoliberalism of the fifth wave can only be understood as a way out of the impasses of the fourth, the Keynesianism of the fourth as a response to the imbalances and catastrophes of the third, and so on — and the same would go for the defining constellations of technology. This appears to be a singularly promising approach to the study of long waves of fossil development, particularly since it allows for free and full reciprocal action between capitalist laws of motion and all manner of partially independent variables: “Interplay: that was what it was about for Mandel.”72 His theory, as I have rendered it here, gives ample room for the struggle between capital and labor, but this is only one battle among many to be brought into the picture; indeed, the theory is open for almost anything: “Averse to determinism, Mandel advocated an integrated analysis of the entire societal reality.”73 That was both his greatest strength and greatest weakness. As a recent critic points out, Mandel ended up adding variable to variable to variable to variable… until the analytical synthesis threatened to spill out into chaos.74

On the other hand, “the great advantage of his method consists, above all, in its openness to historical contingency.”75 The explanation of one wave must be unlike that of any other, since each wave — as a bounded historical period, not an interval in a predetermined rhythm — is peculiar to itself.76 But it is also an instantiation of a recurrent phenomenon. Mandel’s theory is messy and labyrinthine and intended to be so, because it is, first and foremost, a guide to the study of “actual historical dynamics.”77 What, then, can it tell us, more concretely, about the past, present and future of the capital-energy nexus? This is a question for any number of other studies, but at least a couple of signposts for further research are in order here. I offer some brief reflections on the turns from the first to the second, from the fourth to the fifth and from the fifth to a possible sixth wave yet to come.

To make a long story told elsewhere very short, British industrial capitalism surged forth on a first wave of water-power.78 But in 1825, a signal crisis erupted in the form of a financial crash, followed by a succession of painful, protracted depressions. Extraordinary profits had attracted too much capital to the cotton industry in particular, causing an over-establishment of factories and, consequently, a massive overproduction of commodities, under whose weight the rate of profit now plunged. At the very same time as the banks collapsed — setting the typical pattern of interplay with partially independent variables — the British working-class rose, relieved from the criminalization of all trade union activity when the Combination Laws were repealed, and for the next two decades, the manufacturing districts were shaken by one near-revolutionary uprising after another. It was then that the shift to steam occurred.

The combativeness of key segments of the British working-class — cotton-spinners, handloom-weavers, machine-makers, wool-combers — blocked the path to resuscitated profits. Fortunately for the capitalists, however, they possessed a weapon to do away with them all: automatic machinery. Rolled out in the two decades after 1825, an army of self-acting mules, power looms, machine tools, and other machines effectively wiped out the insurgent collectives, cleared the way for wage reductions and speed-ups and brought the class to the subdued, domesticated state of the high Victorian era. That mechanical army was powered by steam. Fully developed and familiar to manufacturers since the mid-1780s, the new power technology, and I mean power in the dual sense of the term (as in energy and dominance), overtook cheap water only after 1825, when the pressure of the contradictions of the first downswing made the transition imperative.

Steam alone could impel the offensive against labor. Water was embedded in the landscape and integrated in the weather, virtually free to use but located outside of towns, subject to fluctuations in river levels, incapable of running a concentrated mass of accelerating machines. Steam engines, on the other hand, could be put up anywhere and used at anytime: for their fuel was severed from the landscape, detached from weather cycles, brought up from underground as a dead still relic of ancient photosynthesis. Setting it on fire, capital released a completely new source of energy to destroy the resistance of labor. A steep rise in the rate of profit followed, allowing for an upswing in which steam-power opened all sorts of venues for fresh accumulation and remolded the economy in toto: a huge blast from the bellows.

Needless to say, the shop floors of Britain constituted but one, albeit crucial, frontier in this turn from the first to the second long wave. The full role of steam remains to be specified in detail. To follow the guidelines of Mandel, one would need to take into account all the buttons that must be pushed for capital accumulation to exit a structural crisis and revive on a higher level — not only a rise in the rate of surplus value, but also a broadening of markets, a reduction in turnover time, a cheapening of raw materials, and other elements of constant capital, to name some. How did steam power contribute to the mid-nineteenth century victories along these frontiers? A study of the origins of the fossil economy in this first full wave movement would need to delve deeply into the empirical data of the period and subject it to that type of open, pluralist, exuberantly complex analysis Mandel pioneered.79 Yet the outline of the core elements underwriting each successive wave may nevertheless be established as early as the first.

Now jump straight to the apparent paradox of the fifth wave. Unlike steam engines, electricity, automobiles, or petroleum, computers are neither prime movers or transmitters nor sources of energy in themselves, and yet the upswing they carried caused the most extreme CO2 blast in the history of industrialized capital. How can one shed light on that link? Perhaps by accepting Mandel’s view that a major contradiction of the fourth wave was a perilously strong labor movement in the core. As the reserve armies of labor were depleted over the course of the 1960s and the self-confidence of the working class soared towards the wild heights of 1968–73, the high rate of surplus value of the previous two decades could no longer be maintained, and a “fall in the rate of profit became unavoidable.”80 To resolve that crisis, some profound restructuring was exigent. Among the many preconditions for a fifth long wave, Mandel proposed the following: “In order to drive up the rate of profit to the extent necessary to change the whole economic climate, under the conditions of capitalism, the capitalists must first decisively break the organizational strength and militancy of the working class in the key industrialized countries.”81 Did computer technology assist them in that battle? If so, how was it connected to the increased combustion of fossil fuels? An exhaustive inquiry is far beyond the scope of this essay: here I offer a crude hypothesis. It runs something like this:

(1) The globalization of production broke the strength of labor in the advanced capitalist countries. By pitting workers there against workers in Mexico, Brazil, the post-Stalinist Eastern European economies, but primarily in China, they all became mutually substitutable to an extent never seen before. Armed with the capacity to shift commodity production to distant countries and export from there, within the framework of integrated cross-border supply chains, employers could push unions to the wall, by threatening that “unless you accept our demands, we will relocate.” Beginning in the late 1970s, culminating with the admission of China into the WTO in 2001, the globalization of production removed one of the main hurdles to a capitalist renaissance. It gave a critical contribution to the relative rebound of the profit rate after the dismal lows of the 1970s.(2) The very same process caused an unprecedented explosion in CO2 emissions. In China, the quest for cheap and disciplined workers, with whom all other workers of the world had to compete, set off the largest spree in fossil fuel consumption in history: cross-border chains extending into the People’s Republic and, indeed, the four corners of the world demanded fresh infrastructure for the supply of energy, which, incidentally, mostly came from coal. They were held together by the transportation of goods, components, raw materials and personnel in vehicles fuelled by petroleum.82Overall, the globalization of production extended the logic of the fossil economy to new territories, giving the main impetus for the epochal boom in combustion outside the traditional core.(3) Information and communications technology, or ICT, made the globalization of production possible. One of the most revolutionary services of this technological paradigm consisted in linking, coordinating, lubricating world-encompassing production chains: without ICT, globalization as we know it would have been unthinkable. As one geographer notes, the opening of the gates to China from the late 1970s onwards coincided with the rise of virtual bridges: “In the West, the combination of two industries, computers and communications, began providing the enabling technology for industrial capital to seek out and manage cheap labor on a global scale.”83 By allowing it to create transnational circuits, ICT turned into a battering ram against the defenses of labor, realizing the substitutability of industrial workers and unleashing the full force of existing power technologies across borders.

Finally yet importantly, humanity is now faced with the imminent prospect of catastrophic global warming, the sum of all the CO2 blasted into the air since the Industrial Revolution. At the same time, since the financial crash of 2008, central components of the capitalist world economy — the European Union, the United States, the People’s Republic of China — appear mired in relative stagnation of various degrees of depth and volatility, with some attendant symptoms of political crisis: a pretty good match for a fifth downswing. That conjunction gives rise to an intriguing possibility. Could capitalism swing itself into a sixth long wave by casting off fossil fuels and switching to renewables — just what humanity needs to stave off the most intolerable scenarios of climate change? Every nook and cranny of the world economy urgently needs to be disconnected from coal and oil and gas and filled with substitutes that come close to zero emissions: a grand transition to impelling, conveying, lifting, hauling, heating, pumping, communicating, doing everything with the power of sun, wind, water. Might such a universal rollout of new power technology breathe fresh air into languishing capitalism and ensure that we collectively back off from the cliff in time?

Probably the most elaborate case for such a future has been made by John A. Mathews, who builds directly on the work of Perez. He believes that the crash of 2008 signaled the descent into the crisis-ridden stage of yet another “surge,” which will usher in a sweeping adoption of the renewable energy technologies (abbreviated RE) already in store and under development, leading, via a bumpy ride over the next couple of decades, into a rich green Kondratieff. These beneficent technologies perfectly fit the profile of a wave-carrying paradigm: they enable, first of all, “costs and prices to be drastically reduced.” They are of virtually unlimited supply. They have “massive potential for applications and so for becoming pervasive,” causing productivity to spike, spurring other novel technologies — electric vehicle charging systems, smart grids managed online, cities filled with intelligent green buildings — opening up unimagined channels for the accumulation of capital. The bottom-line is never in doubt. “The point is,” Mathews writes, “to demonstrate that the new technology provides superior performance and profits”: only by dint of this quality can it be expected to trigger a proper surge.84

Hence the agent of the transition in this new wave of capital shed of carbon will be capital itself. “It is capitalist emulation and drive for profits that will accelerate the uptake of renewable energy sources,” the spirit of creative destruction harnessed for the most virtuous goal, firms scrambling to satisfy consumer demand with the lowest possible emissions and enriching themselves fabulously in the process.85 More precisely, it is the financial sector that will drive the switch. Applying another model from Perez — the arrival of new technologies are accompanied by financial bubbles (think of the British railway mania in the 1830s and 1840s or the more recent dotcom boom) — Mathews predicts that the profit potentials of RE will attract frenzied investment from venture capitalists, the whole pack of adventurous speculators following the scent of super-profits. “If the last decade has seen REs emerging from out of their long (prolonged) gestation phase and into the installation phase, then we can anticipate a ‘Renewable Energy bubble’ some time perhaps around 2015–2020” — this was written in 2013 — “reflecting the surge of financing and credit creation into the field of REs and green technologies.”86 In this prognosis, the future is bright green like a budding leaf. “Through direct market connections, and through the aggregating effects of financial instruments, the entire economy will be brought within the ambit of new capitalist eco-calculations that bring ecological limits to the center of concern.”87

Now what would happen were one to choose Mandel instead of Perez as a source for speculation? The first lesson of his theory is clear: never underestimate the ability of capitalism to reinvent itself.88 Never stick to orthodox formulas that always proclaim the end of the road. Prepare to be taken aback by capital, whose flexibility and resourcefulness have confuted so many prophecies of breakdown so many times before. That said, there are a number of question marks to be jotted down alongside Mathews’s storyline. First of all, it might be a category mistake to conceive of a conversion to renewable energy as analogous to any of the technological leaps experienced since the mid-nineteenth century.89 Going from fossil fuels to renewables — completely, no delay — is quite unlike adding automobiles, airplanes, and petrochemicals to the arsenal of capitalist productive forces. Since the original switch between the first and the second waves, when the fossil economy emerged in full, the upswings have been predicated on technologies for more extensive consumption of fossil fuels: but this time, we are talking about a reversion to qualitatively different type of energy. If, since the high Victorian era, every “great surge of development,” to use the sanguine neo-Schumpeterian terminology, has materialized through fossil energy, this one would have to break out of that mould and re-embed itself in the kind of energy the very first structural crisis jettisoned. The adequate analogy would rather seem be that singular transition — now in reverse, and on an unfathomably larger scale.

The question to ask, then, is if capital accumulation in general and a phase of renewed expansion in particular are compatible with an exclusive use of sun, wind and water. Or is there something in fossil fuels that make their energy indispensable for capital? As much as ever, the currents that make up “RE” remain integrated in landscapes and subject to fluctuations in weather. Can capital survive if fettered to the places and hours where the sun happens to shine and the wind to blow? More to the point: can it thrive within such fetters? They would seem to contravene the logic of globalized and lean production — a problem Mathews conveniently ignores, when he posits the sixth surge as essentially a renewable continuation of the fifth (whereas it has to remove carbon lock-in inherited from the fourth wave, in the form of inter alia the oil industry).90 But perhaps some sort of reconciliation can come about. Perhaps several different renewables from many topographic regions can be connected in overarching mega-grids that elevate them above the concrete determinants of landscape and weather, making them available practically anywhere anytime. Now that obviously requires comprehensive planning, most probably by other agents than venture capitalists, quite likely by states interfering deeply into the flow of energy. Can capital reconcile itself to such meddling — let alone gain from it?

I have offered some more detailed, though rather skeptical reflections on these issues elsewhere.91 Here I note one further complication: all upswings so far have rested on the freedom to consume vastly greater quantities of energy than the previous wave. There has never been any other way to feed growth in commodity production. If this history is anything to go by, a sixth upswing would not only have to replace the current total consumption of fossil fuels by an equal amount of renewable energy: it would have to add a significant margin for growth — not 100 percent of oil and coal and gas, but 120 or 150 or even more would need to be extracted from unfossilized energy within the course of a few decades. It seems a tall order. The alternative, of course, would be to reduce energy consumption, beginning with its wastage: something no previous upswing has ever had to worry about. Growing by slimming seems alien to the workings of capital. But, again, one should not discount its capacity for miraculous reinvention.

Then there are some straightforward empirical problems in Mathews’s assessment. The evidence for the emergence of an RE bubble is, to put it mildly, mixed. Total capital invested worldwide in renewables fell by 23 percent between 2011 and 2013. It rebounded in 2014, by some 17 percent over the previous year.92 Total investment in fossil energy was some four times larger, meaning — it bears repeating — that for every dollar used to build up RE capacity, four other dollars were ploughed into oil, coal, gas. The International Energy Agency predicts a similar distribution until 2035 — no world-saving speculative binge in sight — and notes matter-of-factly: “Getting the world on a 2°C emissions path would mean a different investment landscape.”93 So far, the money does not quite seem to roll into the green Kondratieff corner. Mega-projects for concentrated solar power in deserts — notably Desertec — “promise as many associated investment opportunities as there are entrepreneurs to find them,” Mathews has declared, but in reality the entrepreneurs have fled that ship like rats.94 By the time of this writing, the Desertec project appears to have utterly failed. The eco-Schumpeterian storyline is built on the premise of secularly falling prices for renewables — entirely realistic — and just as secularly rising prices for fossil fuels, which, however, are directly contradicted by the present collapse in the price of oil. And then it hasn’t even considered the possibility that it might not be very lucrative to market a fuel that is practically gratis. Where will the profits to the energy supplier come from when the price of solar power approaches zero?95

Finally, Mandel leads me to a rather different set of questions. How could investment in renewable energy not only deliver profits but underpin the steep rise in the average rate of profit required for capital to embark on a new upswing? In what sense could it constitute the solution to the contradictions of the fifth structural crisis? Could it serve capital as a bulldozer by which to break down the growing obstacles? It does not seem to be a self-driving bulldozer, not a force advancing on its own, spreading “new and superior ways of doing things” while society adapts more or less pliantly. Mathews seeks to distance himself from technological determinism, but he never poses the profoundly social question of a Marxist perspective on energy in the waves: what source could help capital to defeat its enemies, including itself?

The answer depends, of course, on the exact nature of the contradictions of the present conjuncture. Let us, for the sake of argument, accept the proposition that capital now, in a reversal of the situation in the 1970s, suffers from too weak labor, unable to purchase all the commodities churned out, so that over-production, over-capacity, over-accumulation have become near-chronic maladies of the world economy. Then perhaps giant public — note public — investment programs in renewables could provide just the injection of demand capital so desperately and impotently craves. But that remains pure speculation. So far, no capitalist class has taken any initiatives in the direction of climate Keynesianism on an epochal scale. Under the banners of free trade and austerity, that class rather continues to push states further away from influence over investment and squeeze out the last drops from public budgets and working-class earnings, and as Naomi Klein has eloquently argued, such strategies for renewed accumulation run exactly counter to the prerequisites for a switch.96 To speak in the terms of Mandel, climate Keynesianism seems to necessitate a subjective factor, some sort of social force more external and hostile than internal and congenial to capital. It has yet to appear on the stage.

But then one should not forget the partially independent variables. This time, the climate system itself might prove one such externality. An extreme climate emergency could shove this mode of production in an unforeseen direction. Indeed, if any prophecy about the next phase of capitalist development can be made with anything like certainty, it is that global warming will be a determining external condition through whose channel it must flow. Once in there, all known wave patterns might eventually — this sort of breakdown cannot be excluded — come to an end along with everything else. However, before we reach that point, and to make it slightly less likely, a rediscovery of Mandel’s method and painstaking application of it to the realities of our day, always with an eye on the subjective factor, might be of a little help.

- Under this definition, non-capitalist fossil economies are perfectly possible and have indeed existed in the shape of Stalinist formations. For some reflections on them, see Andreas Malm, “Who Lit this Fire? Approaching the History of the Fossil Economy,” Critical Historical Studies, 3.2 (Fall 2016) 215–248.BACK

- As pointed out by, for example, Leon Trotsky, The First Five Years of the Communist International (London: Pathfinder, 1973) 226; Michael Storper and Richard Walker, The Capitalist Imperative: Territory, Technology, and Industrial Growth (Oxford: Basil Blackwell, 1989), 202; Ernest Mandel, Long Waves of Capitalist Development: A Marxist Interpretation (London: Verso, 1995) 120; Chris Freeman and Francisco Louçã, As Time Goes By: From the Industrial Revolutions to the Information Revolution (Oxford: Oxford UP, 2002) 43, 55; Carlota Perez, Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages (Cheltenham: Edward Elgar, 2002) 162. “The stage on which capitalist history is played out is always on the move.” Anwar Shaikh, “The Falling Rate of Profit as the Cause of Long Waves: Theory and Empirical Evidence,” New Findings in Long Wave Research, eds. Alfred Kleinknecht, Ernest Mandel and Immanuel Wallerstein (London: Macmillan, 1992) 174.BACK

- As emphasized with particular clarity by Trotsky, The First Five 252; Leon Trotsky, “The Curve of Capitalist Development,” article originally appearing in Russian in Vestnik Sosialisticheskoi Akademii, 1923, available at marxists.org.BACK

- N. D. Kondratieff, “The Long Waves in Economic Life,” Review of Economic Statistics, 17 (1935) 105–115. On Kondratieff, his theory, and the theories of his many predecessors, see Freeman and Louçã, As Time 66-92. Klas Eklund “Long Waves in the Development of Capitalism?” Kyklos 33 (1980) 383–419, remains an excellent survey of long wave theories.BACK

- Ernest Mandel, Late Capitalism (London: Verso, 1978) 122; Mandel, Long Waves 1; Freeman and Louçã, As Time 141; Phillip Anthony O’Hara, Growth and Development in the Global Political Economy: Social Structures of Accumulation and Modes of Regulation(London: Routledge, 2006) 6; Tessaleno Devezas, “Crises, Depressions, and Expansions: Global Analysis and Secular Trends,” Technological Forecasting and Social Change 77 (2010) 739–761; Chris Freeman, “Technology, Inequality, and Economic Growth,” Innovation and Development 1 (2011) 11–24; Andrey V. Korotayev & Leonid E. Grinin, “Kondratieff Waves in the World System Perspective,” Kondratieff Waves: Dimensions and Prospects at the Dawn of the 21st Century, eds. Leonid Grinin, Tessaleno Devezas & Andrey Korotayev (Volgograd: Uchitel, 2012) 48–51.BACK

- Kondratieff, “The Long Waves.” It speaks to his scientific vision that Kondratieff discerned the wave pattern only on the basis of the first two-and-a-half waves.BACK

- This is not to say that the existence of long waves is empirically uncontroversial — to the contrary — but overall, it has been easier to point to an actual rhythm of alternating upturns and downturns corresponding approximately to the chronology above than to theoretically explain it. See, for example, Eric Hobsbawm, On History (London: Abacus, 1998) 36–37, 66. For recent collections of an impressive array of data showing relatively high levels of growth of world GDP in the upswings and low ditto in the downswings, see Devezas, “Crisis, Depressions,” and Korotayev & Grinin, “Kondratieff Waves.”BACK

- Eklund, “Long Waves” 412–413. Even Angus Maddison, who sets out to refute the theory of long waves, ends up endorsing a (somewhat diluted) version of it under the force of the data: “There have been five distinct phases of economic performance in the capitalist epoch, each with its own momentum.” Angus Maddison, “Fluctuations in the Momentum of Growth within the Capitalist Epoch,” Cliometrica 1 (2007) 171. (This is gleefully noticed and discussed by Devezas, “Crisis, Depressions” 752–753.)BACK

- Freeman & Louçã, As Time, 139–142. Long wave theory is thus based on the crucial distinction between invention and diffusion: “Scientific-technical inventions in themselves, however, are insufficient to bring about a real change in the technique of production. They can remain ineffective so long as economic conditions favorable to their application are absent.” “The Long Waves,” 112.BACK

- As noticed by Espen Moe, “Energy, Industry and Politics: Energy, Vested Interests, and Long-Term Economic Growth and Development,” Energy 35 (2010) 1732.BACK

- Based on Freeman & Louçã, As Time 141. Similar lists, with slight variations, can be found in, for example, Mandel Late Capitalism 120–121; Mandel Long Waves 33; Perez, Technological Revolutions 10–11, 14; George F. Ray “Energy and the Long Cycles,” Energy Economics 5 (1983) 5; Arnulf Grübler and Helga Nowotny, “Towards the Fifth Kondratiev Upswing: Elements of an Emerging New Growth Phase and Possible Development Trajectories,” International Journal of Technology Management 5 (1990): 437; Peter Dicken, Global Shift: Transforming the World Economy. Third Edition (London: Paul Chapman, 1998) 148; Bo Göransson and Johan Söderberg, “Long Waves and Information Technologies: On the Transition towards the Information Society,” Technovation 25 (2005) 205; Chris Papenhausen, “Causal Mechanisms of Long Waves,” Futures 40 (2008) 789; Carlota Perez, “Technological Revolutions and Techno-Economic Paradigms,” Cambridge Journal of Economics 34 (2010) 192, 195–197.BACK

- For an analysis of this conjuncture, and more precisely of the shift from water to steam in British industry, see Andreas Malm, Fossil Capital: The Rise of Steam Power and the Roots of Global Warming (London: Verso, 2016).BACK

- Craig S. Volland, “A Comprehensive Theory of Long Wave Cycles,” Technological Forecasting and Social Change 32 (1987) 127; “The Long Waves” 109; Ray, “Energy” 5. See further W. Seifritz and J. Hodgkin, “Nonlinear Dynamics of the Per Capita Energy Consumption,” Energy 16 (1991) 615–620; Patrick Criqui, “Energy Crises and Economic Crisis: A Long-Period Perspective,” Energy Studies Review 6 (1994) 34–46; Bruce Podobnik, “Toward a Sustainable Energy Regime: A Long-Wave Interpretation of Global Energy Shifts,” Technological Forecasting and Social Change 62 (1999) 155–172; Jonathan Koehler, “Long Run Technical Change in an Energy-Environment-Economy (E3) Model for an IA System: A Model of Kondratiev Waves,” Working Paper 15, Tyndall Centre for Climate Change Research, 2002; João Carlos de Oliveira Matias and Tessaleno Campos Devezas, “The Fifth Kondratieff Wave: The Fossil Fuel Apogee,” Workshop Presentation, IV International Workshop on Oil and Natural Gas, Lisbon, May 10–20, 2005; Göransson and Söderberg, “Long Waves” 207–208; Robert U. Ayres, “Turning Point: The End of Exponential Growth?,” Technological Forecasting and Social Change 73 (2006) 1196–1197; A. T. C. Jérôme Dangerman & Hans Joachim Schellnhuber, “Energy Systems Transformation,” Proceedings of the National Academy of Science (2013) E554–555.BACK

- For the concept of technomass, see Alf Hornborg, The Power of the Machine: Global Inequalities of Economy, Technology, and Environment (Walnut Creek: AltaMira, 2001) 11, 17, 85, 94. On the construction of energy infrastructures in the long waves, cf. Bruce Podobnik, Global Energy Shifts: Fostering Sustainability in a Turbulent Age (Philadelphia: Temple UP, 2006) 61–62.BACK

- “Railway systems originating in the middle of the nineteenth century are still very important today. Electrical technology is the essential foundation for electronic systems and the automobile has certainly not disappeared.” As Time 145.BACK

- The relative shift from coal to oil after World War II coexisted with continued absolute increases of coal output, as pointed out, importantly, by Podobnik, “Toward a Sustainable” 157.BACK

- See George A. Gonzalez, Urban Sprawl, Global Warming, and the Empire of Capital(Albany: SUNY Press, 2009).BACK

- Perez, Technological Revolutions 20. Note that Perez is by no means an anti-capitalist: these insights do not depend upon opposition to the system.BACK

- Mandel, Late Capitalism; Mandel, Long Waves. A brilliant biography of Mandel is Jan Willem Stutje, Ernest Mandel: A Rebel’s Dream Deferred (London: Verso, 2009).BACK

- Late Capitalism 109. Emphasis in original. The waves are said to be most obvious in advanced capitalist countries, as opposed to the lagging peripheries of the system. Long Waves 2.BACK

- On the role of these two indicators, see, for example, Late Capitalism 141; Long Waves6.BACK

- Late Capitalism 122; Long Waves 21. See also “The Long Waves” 111, and The First Five253–254.BACK

- Trotsky, “The Curve.” An excellent rendering of the debate is Richard B. Day “The Theory of the Long Cycle: Kondratiev, Trotsky, Mandel,” New Left Review no. 99 (1976) 67–82.BACK

- “The Curve.”BACK

- See also, Eklund, “Long Waves” 389.BACK

- Long Waves 82. See further, for example, 76–81, 99, and Late Capitalism 128–9.BACK

- Hobsbawm, On History 37.BACK

- For example Late Capitalism 133, and Long Waves 76.BACK

- The First Five 252; Late Capitalism 129; On History 66.BACK

- “The Long Waves” 112–113.BACK

- See also Day, “The Theory” 81. The third main source of inspiration for Mandel’s theory of long waves was, of course, Joseph Schumpeter. See also Francisco Louçã, “Ernest Mandel and the Pulsation of History,” The Legacy of Ernest Mandel, ed. Gilbert Achcar (London: Verso, 1999) 104.BACK

- Ernest Mandel, “Partially Independent Variables and Internal Logic in Classical Marxist Economic Analysis,” Social Science Information 24 (1985) 485–505.BACK

- Ernest Mandel, “Explaining Long Waves of Capitalist Development,” Futures 13 (1981) 336.BACK

- Mandel, “Partially Independent” 489.BACK

- “Partially Independent” 490–495.BACK

- “Partially Independent” 492.BACK

- Long Waves 133. See also, Louçã, “Ernest Mandel” 107; William Hamilton Sewell Jr., Logics of History: Social Theory and Social Transformation (Chicago: Chicago University Press, 2005) 11. One could of course argue that these types of factors are so interwoven as to be virtually impossible to separate — as is so often the case with an analysis informed by the dialectical method.BACK

- As argued in “The Theory” 81–82.BACK

- See also Marcel van der Linden and Jan Willem Stutje, “Ernest Mandel and the Historical Theory of Global Capitalism,” Historical Materialism 15 (2007) 39–41.BACK

- For a powerful restatement of this classical view and demonstration of its validity, see Andrew Glyn, “Does Aggregate Profitability Really Matter?” Cambridge Journal of Economics 21 (1997) 593–619.BACK

- Long Waves 20, 110.BACK

- For a stylized scenario, see Long Waves 44–46.BACK

- Mandel, “Explaining” 335; Stutje, Ernest Mandel 190; Late Capitalism 133. Emphasis in original. See also, Minqi Li, Feng Xiao and Andong Zhu, “Long Waves, Institutional Changes, and Historical Trends: A Study of the Long-Term Movement of the Profit Rate in the Capitalist World-Economy,” Journal of World-Systems Research 13 (2007) 33.BACK

- “Explaining” 335.BACK

- Late Capitalism 145. See also 108–9, 114, 120; Long Waves 7, 16.BACK

- Late Capitalism 110. In the rate of profit, then, Mandel fuses all the multiple endogenous and exogenous variables in a single factor so “close to the system’s heart as to make one understand why changes in that factor can precipitate a change in the way in which the system as a whole grows or does not grow.” “Explaining” 335.BACK

- Long Waves 33, 36–37, 118–19, 123, 128, 137.BACK

- In the midst of the fourth downswing — the first edition of Long Waves appeared in 1980 — Mandel listed the conditions for a new upswing, among them “a qualitative increase in the degree of integration of the USSR and China into the international capitalist market,” a decisive break of “the organizational strength and militancy of the working class in the key industrialized countries,” “radical rather than marginal changes in the transformation of some key areas in the so-called third world into large markets,” “radical defeats of national liberation movements.” Long Waves 87–90.BACK

- Late Capitalism 112, 118–119. See also 116–117. All emphases except the first added. Note that the selection of key technologies in this schema deviates from the modern consensus. See also Louçã, “Ernest Mandel” 117. The point here, however, is not the identity of the technologies singled out by Mandel, but the historical role he ascribes to them.BACK

- Late Capitalism 118–119.BACK

- Late Capitalism 112.BACK

- Long Waves 33.BACK

- Late Capitalism 115–116, 119.BACK

- Late Capitalism 137, 143–144; Long Waves 19.BACK

- Late Capitalism 145.BACK

- Late Capitalism 145.BACK

- With very rare exceptions, for example, the statement that each wave is associated with “new machine systems, based on different sources of energy” (Long Waves 112). In this book, however, the main theme and purported original contribution is the theory of asymmetry in the long waves: the turn into a downswing — the outbreak of depression — is exclusively caused by the laws of motion of capital itself, whereas the upturn is precipitated by a beneficial outcome of class and other political struggles. See for example 104. This theory is dubious: there appears to be no a priori reason to deny exogenous shocks a role in the outbreak of crises. Be that as it may, it is the power theory of Late Capitalism, not the asymmetry of Long Waves, that is of value to us.BACK

- The analytical poverty of energy theory in the Marxist school of long waves is on full display in Matthew Edel, “Energy and the Long Swing,” Review of Radical Political Economics 15 (1983) 115–130, written at a time when Mandel’s influence was at its peak. It contains no discussion of the above passages from Late Capitalism.BACK

- Perez, Technological Revolutions 155.BACK

- Technological Revolutions 38. See also 15.BACK

- Technological Revolutions 20–32, 41–43. “Mental maps” 20.BACK

- Technological Revolutions 6, 26, 153, 155; See also Perez “Technological Revolutions” 198.BACK

- Technological Revolutions 23.BACK

- Technological Revolutions 36. Emphasis added. See also, for exmple, 145.BACK

- Technological Revolutions 41–43, and “Technological Revolutions” 188, 194–195.BACK

- Technological Revolutions 15. Emphasis added.BACK

- Technological Revolutions 26.BACK

- Technological Revolutions 29–30, 48. On the “big bangs” — unexplained events of an almost cosmological character — see 11–12, 29.BACK

- Technological Revolutions 11, 57.BACK

- Louçã, “Ernest Mandel” 113.BACK

- Technological Revolutions 8; “Technological Revolutions” 191.BACK

- Stutje, Ernest Mandel 191. Emphasis added. On the importance of the concept of partially independent variables for opening up long wave theory to history, see also Louçã, “Ernest Mandel” 111; As Time 58. John McNeill contends that long waves can shed no light on environmental history — the discipline whose doyen he is — since they are unrelated to the temporalities of nature. “How can one harmonize this outlook with the rhythms of climate change, which in any case are not uniform around the world, and are surely quite independent from any economic cycles that may derive from human affairs?” J. R. McNeill, “Observations on the Nature and Culture of Environmental History,” History and Theory 42 (2003) 38. But this is to conflate the issue of how natural processes impact on society with that of how social processes impact on nature: if the latter is in focus, long waves might very well be central to the explanation.BACK

- Ernest Mandel 187. Emphasis added.BACK

- Michael R. Krätke, “On the History and Logic of Modern Capitalism: The Legacy of Ernest Mandel,” Historical Materialism 15 (2007) 126–128.BACK

- van der Linden & Stutje, “Ernest Mandel” 41.BACK

- See also Freeman & Louçã, As Time 111, 131, 150; Rodney Edvinsson, Growth, Accumulation, Crisis: With New Macroeconomic Data for Sweden 1800–2000 (Stockholm: Almqvist & Wiksell International, 2005) 31, 167–168, 285–286, 289–290; Rainer Metz, “Do Kondratieff Waves Exist? How Time Series Techniques Can Help Solve the Problem,” Cliometrica 5 (2011) 235–236. On Mandel’s different explanations for each wave, see Late Capitalism 130–132, 145.BACK

- Eklund, “Long Waves” 414. Emphasis in original. See also Late Capitalism 145; Stutje, Ernest Mandel 169, 194.BACK

- See Malm, “Who Lit?”BACK

- This task will be taken up in Fossil Empire, the sequel to Malm, Fossil Capital.BACK

- Long Waves 73.BACK

- Long Waves 88.BACK

- For a more detailed analysis of this dynamic, see Fossil Capital 327–366.BACK

- Peter J. Taylor, “Thesis on Labour Imperialism: How Communist China Used Capitalist Globalization to Create the Last Great Modern Imperialism,” Political Geography, 30 (2011) 175. Emphasis added.BACK

- John A. Mathews, “The Renewable Energies Technology Surge: A New Techno-Economic Paradigm in the Making?” Futures 46 (2013) 12–16. Emphasis added.BACK

- John A. Mathews, “Naturalizing Capitalism: The Next Great Transformation,” Futures 43 (2011) 872.BACK

- Mathews, “The Renewable Energies” 17.BACK

- Mathews, “Naturalizing Capitalism” 874. Emphasis added.BACK

- Late Capitalism 92-93.BACK

- This mistake is also made from a Marxist standpoint by Podobnik, Global Energy Shifts.BACK

- “The Renewable Energies.”BACK

- Fossil Capital.BACK

- Bloomberg New Energy Finance, Global Trends in Renewable Energy Investment 2014; Bloomberg New Energy Finance, Global Trends in Renewable Energy Investment 2015, bnef.com.BACK

- Figure and quotation from International Energy Agency, World Energy Investment Outlook 2014 Factsheet Overview, www.iea.org, 1. Emphasis added.BACK

- “The Renewable Energies” 16.BACK

- See further Fossil Capital.BACK

- Naomi Klein, This Changes Everything: Capitalism vs. the Climate (London: Penguin, 2014).BACK

No comments:

Post a Comment