By Michael E. Webber, The New York Times, November 15, 2016

Austin, Tex. — Donald J. Trump made many important campaign promises on his way to victory. But saving coal is one promise he won’t be able to keep.

Many in Appalachia and other coal-mining regions believe that President Obama’s supposed war on coal caused a steep decline in the industry’s fortunes. But coal’s struggles to compete are caused by cheap natural gas, cheap renewables, air-quality regulations that got their start in the George W. Bush administration and weaker-than-expected demand for coal in Asia.

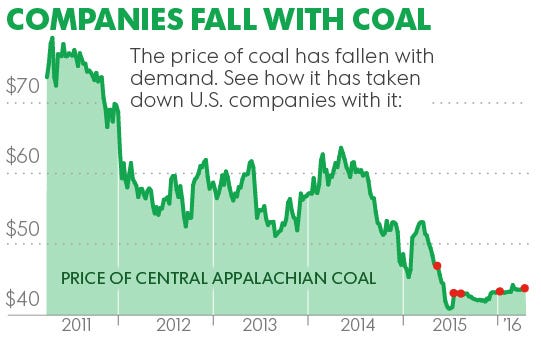

Nationwide, coal employment peaked in the 1920s. The more recent decline in Appalachian coal employment started in the 1980s during the administration of Ronald Reagan because of the role that automation and mechanization played in replacing miners with machines, especially in mountaintop removal mining. Job losses in Appalachia were compounded by deregulation of the railroads. Freight prices for trains dropped as a result, which meant that Western coal — which is much cleaner and cheaper than Eastern coal — could be sold to markets far away, cutting into the market share of Appalachian mines. These market forces recently drove six publicly traded coal producers into bankruptcy in the span of a year.

Mr. Trump cannot reverse these trends.

For Mr. Trump to improve coal’s fate would require enormous market intervention like direct mandates to consume coal or significant tax breaks to coal’s benefit. These are the exact types of interventions that conflict with decades of Republican orthodoxy supporting competitive markets. Another approach, which appears to be gaining popularity, is to open up more federal lands and waters to oil, gas and coal production.

Doing so would only exacerbate coal’s challenges, as it would add to the oversupply of energy, lowering the price of coal, which makes it even harder for coal companies to stay profitable. Those same policy actions would also lead to more gas production, depressing natural gas prices further, which would outcompete coal. Instead of being a virtuous cycle for coal, it looks more like a death spiral. And this is all without environmental regulations related to reducing carbon dioxide emissions, which aren’t even scheduled to kick in for several years.

Even if the president-elect tried to make these moves, surprising opponents might step in his way. Natural gas companies are the primary beneficiaries of, and now defenders of, clean air and low carbon regulations. They include Exxon Mobil, the world’s largest publicly traded international oil and gas company, which operates in a lot of countries that care about reducing carbon emissions. The company issued a public statement in support of the Paris climate agreement on Nov. 4, the day it took effect. Shutting down coal in favor of natural gas, which is cleaner and emits much less carbon, is a big business opportunity for companies like Exxon Mobil.

In the battle between coal companies and major oil and gas producers, I expect the latter will be victorious.

The rapid uptake of cheap renewables is also a contributor to coal’s demise. Mr. Trump made campaign comments suggesting the end of support for renewable energy technologies. But his recent statements call for supporting all energy forms, including renewables, suggesting he won’t target them after all.

Even if he did, what are his options? Their tax subsidies are already scheduled to expire or shrink. Plus, wind and solar farms are usually installed in rural Republican districts, which explains why they get so much Republican support in the first place. All those rural districts in America’s wind corridor might not be thrilled if their preferred candidate seeks to undermine one of their most important sources of economic growth.

The saving grace for coal production in the United States may be exports to Europe or China. But Europe’s demand for coal is waning. And Mr. Trump seems to be marching us toward a trade war with China. Doing so means the Chinese could retaliate by not buying our coal. And even if a trade war is avoided, cheap coal is readily available from nearby Australia.

What does this mean for the average American? More of the same when it comes to energy, which is a good thing. Energy prices will stay low and our air quality will keep improving. And both will help the economy grow.

Any way you slice it, coal’s struggles are real and hard to mitigate. No matter how much Mr. Trump tries to protect coal from market competition, doing so will be hard to execute and will get him crosswise with important Republican stakeholders and long-held Republican policy priorities.

Michael E. Webber is the deputy director of the Energy Institute at the University of Texas, Austin, and author of “Thirst for Power: Energy, Water and Human Survival.”

No comments:

Post a Comment