It's not looking good for the global fossil fuel industry. Although the world remains heavily dependent on oil, coal and natural gas -- which today supply around 80 percent of our primary energy needs -- the industry is rapidly crumbling.

This is not merely a temporary blip, but a symptom of a deeper, long-term process related to global capitalism's escalating overconsumption of planetary resources and raw materials.

New scientific research shows that the growing crisis of profitability facing fossil fuel industries is part of an inevitable period of transition to a post-carbon era.

But ongoing denialism has led powerful vested interests to continue clinging blindly to their faith in fossil fuels, with increasingly devastating and unpredictable consequences for the environment.

Bankruptcy Epidemic

In February, the financial services firm Deloitte predicted that over 35 percent of independent oil companies worldwide are likely to declare bankruptcy, potentially followed by a further 30 percent next year -- a total of 65 percent of oil firms around the world. Since early last year, already 50 North American oil and gas producers have filed bankruptcy.

The cause of the crisis is the dramatic drop in oil prices -- down by two-thirds since 2014 -- which are so low that oil companies are finding it difficult to generate enough revenue to cover the high costs of production, while also repaying their loans.

Oil and gas companies most at risk are those with the largest debt burden. And that burden is huge -- as much as $2.5 trillion, according to The Economist. The real figure is probably higher.

At a speech at the London School of Economics in February, Jaime Caruana of the Bank for International Settlements said that outstanding loans and bonds for the oil and gas industry had almost tripled between 2006 and 2014 to a total of $3 trillion.

This massive debt burden, he explained, has put the industry in a double-bind: In order to service the debt, they are continuing to produce more oil for sale, but that only contributes to lower market prices. Decreased oil revenues means less capacity to repay the debt, thus increasing the likelihood of default.

Stranded Assets

This $3 trillion of debt is at risk because it was supposed to generate a 3-to-1 increase in value, but instead -- thanks to the oil price decline -- represents a value of less than half of this.

Worse, according to a Goldman Sachs study quietly published in December last year, as much as $1 trillion of investments in future oil projects around the world are unprofitable, effectively stranded.

Examining 400 of the world's largest new oil and gas fields (except U.S. shale), the Goldman study found that $930 billion worth of projects (more than two-thirds) are unprofitable at Brent crude prices below $70. (Prices are now well below that.)

The collapse of these projects due to unprofitability would result in the loss of oil and gas production equivalent to a colossal 8 percent of current global demand. If that happens, suddenly or otherwise, it would wreck the global economy.

The Goldman analysis was based purely on the internal dynamics of the industry. A further issue is that internationally-recognized climate change risks mean that to avert dangerous global warming, much of the world's remaining fossil fuel resources cannot be burned.

All of this is leading investors to question the wisdom of their investments, given fears that much of the assets that the oil, gas and coal industries use to estimate their own worth could consist of resources that will never ultimately be used.

The Carbon Tracker Initiative, which analyzes carbon investment risks, points out that over the next decade, fossil fuel companies risk wasting up to $2.2 trillion of investments in new projects that could turn out to be "uneconomic" in the face of international climate mitigation policies.

More and more fossil fuel industry shareholders are pressuring energy companies to stop investing in exploration for fear that new projects could become worthless due to climate risks.

"Clean technology and climate policy are already reducing fossil fuel demand," said James Leaton, head of research at Carbon Tracker. "Misreading these trends will destroy shareholder value. Companies need to apply 2C stress tests to their business models now."

In a prescient report published last November, Carbon Tracker identified the energy majors with the greatest exposures -- and thus facing the greatest risks -- from stranded assets: Royal Dutch Shell, Pemex, Exxon Mobil, Peabody Energy, Coal India and Glencore.

At the time, the industry scoffed at such a bold pronouncement. Six months after this report was released -- a week ago -- Peabody went bankrupt. Who's next?

The Carbon Tracker analysis may underestimate the extent of potential losses. A new paper just out in the journal Applied Energy, from a team at Oxford University's Institute for New Economic Thinking, shows that the "stranded assets" concept applies not just to unburnable fossil fuel reserves, but also to a vast global carbon-intensive electricity infrastructure, which could be rendered as defunct as the fossil fuels it burns and supplies to market.

The Coming Debt Spiral

Some analysts believe the hidden trillion-dollar black hole at the heart of the oil industry is set to trigger another global financial crisis, similar in scale to the Dot-Com crash.

Jason Schenker, president and chief economist at Prestige Economics, says: "Oil prices simply aren't going to rise fast enough to keep oil and energy companies from defaulting. Then there is a real contagion risk to financial companies and from there to the rest of the economy."

Schenker has been ranked by Bloomberg News as one of the most accurate financial forecasters in the world since 2010. The US economy, he forecasts, will dip into recession at the end of 2016 or early 2017.

Mark Harrington, an oil industry consultant, goes further. He believes the resulting economic crisis from cascading debt defaults in the industry could make the 2007-8 financial crash look like a cakewalk. "Oil and gas companies borrowed heavily when oil prices were soaring above $70 a barrel," he wrote on CNBC in January.

"But in the past 24 months, they've seen their values and cash flows erode ferociously as oil prices plunge -- and that's made it hard for some to pay back that debt. This could lead to a massive credit crunch like the one we saw in 2008. With our economy just getting back on its feet from the global 2008 financial crisis, timing could not be worse."

Ratings agency Standard & Poor (S&P) reported this week that 46 companies have defaulted on their debt this year -- the highest levels since the depths of the financial crisis in 2009. The total quantity in defaults so far is $50 billion.

Half this year's defaults are from the oil and gas industry, according to S&P, followed by the metals, mining and the steel sector. Among them was coal giant Peabody Energy.

Despite public reassurances, bank exposure to these energy risks from unfunded loan facilities remains high. Officially, only 2.5 percent of bank assets are exposed to energy risks.

But it's probably worse. Confidential Wall Street sources claim that the Federal Reserve in Dallas has secretly advised major U.S. banks in closed-door meetings to cover up potential energy-related losses. The Federal Reserve denies the allegations, but refuses to respond to Freedom of Information requests on internal meetings, on the obviously false pretext that it keeps no records of any of its meetings.

According to Bronka Rzepkoswki of the financial advisory firm Oxford Economics, over a third of the entire U.S. high yield bond index is vulnerable to low oil prices, increasing the risk of a tidal wave of corporate bankruptcies: "Conditions that usually pave the way for mounting defaults -- such as growing bad debt, tightening monetary conditions, tightening of corporate credit standards and volatility spikes -- are currently met in the U.S."

The End of Cheap Oil

Behind the crisis of oil's profitability that threatens the entire global economy is a geophysical crisis in the availability of cheap oil. Cheap here does not refer simply to the market price of oil, but the total cost of production. More specifically, it refers to the value of energy.

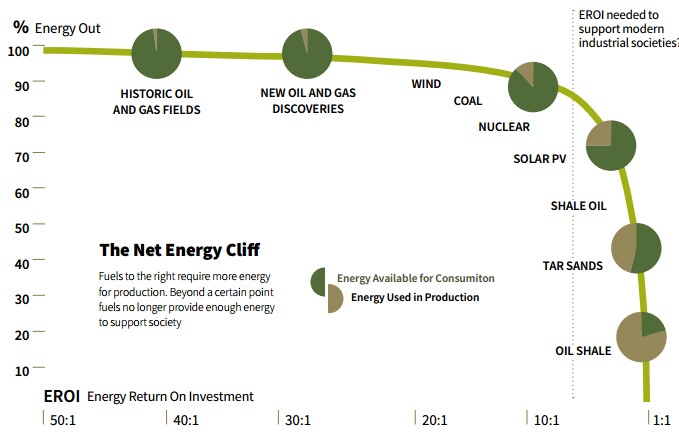

There is a precise scientific measure for this, virtually unknown in conventional economic and financial circles, known as Energy Return on Investment -- which essentially quantifies the amount of energy extracted, compared to the inputs of energy needed to conduct the extraction. The concept of EROI was first proposed and developed by Professor Charles A. Hall of the Department of Environmental and Forest Biology at the State University of New York. He found that an approximate EROI value for any energy source could be calculated by dividing the quantity of energy produced by the amount of energy inputted into the production process.

Therefore, the higher the EROI, the more energy that a particular source and technology is capable of producing. The lower the EROI, the less energy this source and technology is actually producing.

A new peer-reviewed study led by the Institute of Physics at the National Autonomous University of Mexico has undertaken a comparative review of the EROI of all the major sources of energy that currently underpin industrial civilization -- namely oil, gas, coal, and uranium.

Published in the journal Perspectives on Global Development and Technology, the scientists note that the EROI for fossil fuels has inexorably declined over a relatively short period of time: "Nowadays, the world average value EROI for hydrocarbons in the world has gone from a value of 35 to a value of 15 between 1960 and 1980."

In other words, in just two decades, the total value of the energy being produced via fossil fuel extraction has plummeted by more than half. And it continues to decline.

This is because the more fossil fuel resources that we exploit, the more we have used up those resources that are easiest and cheapest to extract. This compels the industry to rely increasingly on resources that are more difficult and expensive to get out of the ground, and bring to market.

The EROI for conventional oil, according to the Mexican scientists, is 18. They estimate, optimistically, that: "World reserves could last for 35 or 45 years at current consumption rates." For gas, the EROI is 10, and world reserves will last around "45 or 55 years." Nuclear's EROI is 6.5, and according to the study authors, "The peak in world production of uranium will be reached by 2045."

The problem is that although we are not running out of oil, we are running out of the cheapest, easiest to extract form of oil and gas. Increasingly, the industry is making up for the shortfall by turning to unconventional forms of oil and gas -- but these have very little energy value from an EROI perspective.

The Mexico team examine the EROI values of these unconventional sources, tar sands, shale oil, and shale gas: "The average value for EROI of tar sands is four. Only ten percent of that amount is economically profitable with current technology."

For shale oil and gas, the situation is even more dire: "The EROI varies between 1.5 and 4, with an average value of 2.8. Shale oil is very similar to the tar sands; being both oil sources of very low quality. The shale gas revolution did not start because its exploitation was a very good idea; but because the most attractive economic opportunities were previously exploited and exhausted."

In effect, the growing reliance on unconventional oil and gas has meant that, overall, the costs and inputs into energy production to keep industrial civilization moving are rising inexorably.

It's not that governments don't know. It's that decisions have already been made to protect the vested interests that have effectively captured government policymaking through lobbying, networking and donations.

Three years ago, the British government's Department for International Development (DFID) commissioned and published an in-depth report, "EROI of Global Energy Resources: Status, Trends and Social Implications." The report went completely unnoticed by the media.

Its findings are instructive: "We find the EROI for each major fossil fuel resource (except coal) has declined substantially over the last century. Most renewable and non-conventional energy alternatives have substantially lower EROI values than conventional fossil fuels."

The decline in EROI has meant that an increasing amount of the energy we extract is having to be diverted back into getting new energy out, leaving less for other social investments.

This means that the global economic slowdown is directly related to the declining resource quality of fossil fuels. The DFID report warns: "The declining EROI of traditional fossil fuel energy sources and its eventual effect on the world economy are likely to result in a myriad of unforeseen consequences."

Shortly after this report was released, I met with a senior civil servant at DFID familiar with its findings, who spoke to me on condition of anonymity. I asked him whether this important research had actually impacted policymaking in the department.

"Unfortunately, no," he told me, shrugging. "Most of my colleagues, except perhaps a handful, simply don't have a clue about these issues. And of course, despite the report being circulated widely within the department, and shared with other relevant government departments, there is little interest from ministers who appear to be ideologically pre-committed to fracking."

Peak Oil

The driving force behind the accelerating decline in resource quality, hotly denied in the industry, is 'peak oil.'

An extensive scientific analysis published in February in Wiley Interdisciplinary Reviews: Energy & Environment lays bare the extent of industry denialism. Wiley Interdisciplinary Reviews (WIRES) is a series of high-quality peer-reviewed publications which runs authoritative reviews of the literature across relevant academic disciplines.

The new WIRES paper is authored by Professor Michael Jefferson of the ESCP Europe Business School, a former chief economist at oil major Royal Dutch/Shell Group, where he spent nearly 20 years in various senior roles from Head of Planning in Europe to Director of Oil Supply and Trading. He later became Deputy Secretary-General of the World Energy Council, and is editor of the leading Elsevier science journal Energy Policy.

In his new study, Jefferson examines a recent 1865-page "global energy assessment" (GES) published by the International Institute of Applied Systems Analysis. But he criticized the GES for essentially ducking the issue of 'peak oil."

"This was rather odd," he wrote. "First, because the evidence suggests that the global production of conventional oil plateaued and may have begun to decline from 2005."

He went on to explain that standard industry assessments of the size of global conventional oil reserves have been dramatically inflated, noting how "the five major Middle East oil exporters altered the basis of their definition of 'proved' conventional oil reserves from a 90 percent probability down to a 50 percent probability from 1984. The result has been an apparent (but not real) increase in their 'proved' conventional oil reserves of some 435 billion barrels."

Added to those estimates are reserve figures from Venezuelan heavy oil and Canadian tar sands, bringing up global reserve estimates by a further 440 billion barrels, despite the fact that they are "more difficult and costly to extract" and generally of "poorer quality" than conventional oil.

"Put bluntly, the standard claim that the world has proved conventional oil reserves of nearly 1.7 trillion barrels is overstated by about 875 billion barrels. Thus, despite the fall in crude oil prices from a new peak in June 2014, after that of July 2008, the 'peak oil' issue remains with us."

Jefferson believes that a nominal economic recovery, combined with cutbacks in production as the industry reacts to its internal crises, will eventually put the current oil supply glut in reverse. This will pave the way for "further major oil price rises" in years to come.

It's not entirely clear if this will happen. If the oil crisis hits the economy hard, then the prolonged recession that results could dampen the rising demand that everyone projects. If oil prices thus remain relatively depressed for longer than expected, this could hemorrhage the industry beyond repair.

Eventually, the loss of production may allow prices to rise again. OPEC estimates that investments in oil exploration and development are at their lowest level in six years. As bankruptcies escalate, the accompanying drop in investments will eventually lead world oil production to fall, even as global demand begins to rise.

This could lead oil prices to climb much higher, as rocketing demand -- projected to grow 50 percent by 2035 -- hits the scarcity of production. Such a price spike, ironically, would also be incredibly bad for the global economy, and as happened with the 2007-8 financial crash, could feed into inflation and trigger another spate of consumer debt-defaults in the housing markets.

Even if that happens, the assumption -- the hope -- is that oil industry majors will somehow survive the preceding cascade of debt-defaults. The other assumption is that demand for oil will rise.

But as new sources of renewable energy come online at a faster and faster pace, as innovation in clean technologies accelerates, old fossil fuel-centric projections of future rising demand for oil may need to be jettisoned.

Clean Energy

According to another new study released in March in Energy Policy by two scientists at Texas A&M University, "Non-renewable energy" -- that is "fossil fuels and nuclear power" -- "are projected to peak around mid-century ... Subsequent declining non-renewable production will require a rapid expansion in the renewable energy sources (RES) if either population and/or economic growth is to continue."

The demise of the fossil fuel empire, the study forecasts, is inevitable. Whichever model run the scientists used, the end output was the same: the almost total displacement of fossil fuels by renewable energy sources by the end of the century; and, as a result, the transformation and localisation of economic activity.

But the paper adds that to avoid a rise in global average temperatures of 2C, which would tip climate change into the danger zone, 50 percent or more of existing fossil fuel reserves must remain unused.

The imperative to transition away from fossil fuels is, therefore, both geophysical and environmental. On the one hand, by mid-century, fossil fuels and nuclear power will become obsolete as a viable source of energy due to their increasingly high costs and low quality. On the other, even before then, to maintain what scientists describe as a 'safe operating space' for human survival, we cannot permit the planet to warm a further 2C without risking disastrous climate impacts.

Staying below 2C, the study finds, will require renewable energy to supply more than 50 percent of total global energy by 2028, "a 37-fold increase in the annual rate of supplying renewable energy in only 13 years."

While this appears to be a herculean task by any standard, the Texas A&M scientists conclude that by century's end, the demise of fossil fuels is going to happen anyway, with or without considerations over climate risks:

… the 'ambitious' end-of-century decarbonisation goals set by the G7 leaders will be achieved due to economic and geologic fossil fuel limitations within even the unconstrained scenario in which little-to-no pro-active commitment to decarbonise is required… Our model results indicate that, with or without climate considerations, RES [renewable energy sources] will comprise 87–94 percent of total energy demand by the end of the century.

But as renewables have a much lower EROI than fossil fuels, this will "quickly reduce the share of net energy available for societal use." With less energy available to societies, "it is speculated that there will have to be a reprioritization of societal energetic needs" -- in other words, a very different kind of economy in which unlimited material growth underpinned by endless inputs of cheap fossil fuel energy are a relic of the early 21st century.

The 37-fold annual rate of increase in the renewable energy supply seems unachievable at first glance, but new data just released from the Abu Dhabi-based International Renewable Energy Agency shows that clean power is well on its way, despite lacking the massive subsidies behind fossil fuels.

The data reveals that last year, solar power capacity rose by 37 percent. Wind power grew by 17 percent, geothermal by 5 percent and hydropower by 3 percent.

So far, the growth rate for solar power has been exponential. A Deloitte Center for Energy Solutions report from September 2015 noted that the speed and spread of solar energy had consistently outpaced conventional linear projections, and continues to do so.

While the costs of solar power is consistently declining, solar power generation has doubled every year for the last 20 years. With every doubling of solar infrastructure, the production costs of solar photovoltaic (PV) has dropped by 22 percent.

At this rate, according to analysts like Tony Seba -- a lecturer in business entrepreneurship, disruption and clean energy at Stanford University -- the growth of solar is already on track to go global. With eight more doublings, that's by 2030, solar power would be capable of supplying 100 percent of the world's energy needs. And that's even without the right mix of government policies in place to support renewables.

According to Deloitte, while Seba's forecast is endorsed by a minority of experts, it remains a real possibility that should be taken seriously. But the firm points out that obstacles remain:

"It would not make economic sense for utility planners to shutter thousands of megawatts of existing generating capacity before the end of its economic life and replace it with new solar generation."

Yet Deloitte's study did not account for the escalating crisis in profitability already engulfing the fossil fuel industries, and the looming pressure of stranded assets due to climate risks. As the uneconomic nature of fossil fuels becomes ever more obvious, so too will the economic appeal of clean energy.

Race Against Time

The question is whether the transition to a post-carbon energy system -- the acceptance of the inevitable death of the oil economy -- will occur fast enough to avoid climate catastrophe.

Given that the 2C target for a safe climate is widely recognized to be inadequate -- scientists increasingly argue that even a 1C rise in global average temperatures would be sufficient to trigger dangerous, irreversible changes to the earth's climate.

According to a 2011 report by the National Academy of Sciences, the scientific consensus shows conservatively that for every degree of warming, we will see the following impacts: 5-15 percent reductions in crop yields; 3-10 percent increases in rainfall in some regions contributing to flooding; 5-10 percent decreases in stream-flow in some river basins, including the Arkansas and the Rio Grande, contributing to scarcity of potable water; 200-400 percent increases in the area burned by wildfire in the US; 15 percent decreases in annual average Arctic sea ice, with 25 percent decreases in the yearly minimum extent in September.

Even if all CO2 emissions stopped, the climate would continue to warm for several more centuries. Over thousands of years, the National Academy warns, this could unleash amplifying feedbacks leading to the disappearance of the polar ice sheets and other dramatic changes. In the meantime, the risk of catastrophic wild cards "such as the potential large-scale release of methane from deep-sea sediments" or permafrost, is impossible to quantify.

In this context, even if the solar-driven clean energy revolution had every success, we still need to remove carbon that has already accumulated in the atmosphere, to return the climate to safety.

The idea of removing carbon from the atmosphere sounds technologically difficult and insanely expensive. It's not. In reality, it is relatively simple and cheap.

A new book by Eric Toensmeier, a lecturer at Yale University's School of Forestry and Environmental Studies, The Carbon Farming Solution, sets out in stunningly accessible fashion how 'regenerative farming' provides the ultimate carbon-sequestration solution.

Regenerative farming is a form of small-scale, localised, community-centred organic agriculture which uses techniques that remove carbon from the atmosphere, and sequester it in plant material or soil.

Using an array of land management and conservation practices, many of which have been tried and tested by indigenous communities, it's theoretically possible to scale up regenerative farming methods in a way that dramatically offsets global carbon emissions.

Toensmeier's valuable book discusses these techniques, and unlike other science-minded tomes, offers a practical toolkit for communities to begin exploring how they can adopt regenerative farming practices for themselves.

According to the Rodale Institute, the application of regenerative farming on a global scale could have revolutionary results:

Simply put, recent data from farming systems and pasture trials around the globe show that we could sequester more than 100 percent of current annual CO2 emissions with a switch to widely available and inexpensive organic management practices, which we term 'regenerative organic agriculture'… These practices work to maximize carbon fixation while minimizing the loss of that carbon once returned to the soil, reversing the greenhouse effect.

This has been widely corroborated. For instance, a 2015 study part-funded by the Chinese Academy of Sciences found that "replacing chemical fertilizer with organic manure significantly decreased the emission of GHGs [greenhouse gases]. Yields of wheat and corn also increased as the soil fertility was improved by the application of cattle manure. Totally replacing chemical fertilizer with organic manure decreased GHG emissions, which reversed the agriculture ecosystem from a carbon source… to a carbon sink."

Governments are catching on, if slowly. At the Paris climate talks, 25 countries and over 50 NGOs signed up to the French government's '4 per 1000' initiative, a global agreement to promote regenerative farming as a solution for food security and climate disaster.

The Birth of Post-Capitalism

There can be no doubt, then, that by the end of this century, life as we know it on planet earth will be very different. Fossil fueled predatory capitalism will be dead. In its place, human civilization will have little choice but to rely on a diversity of clean, renewable energy sources.

Whatever choices we make this century, the coming generations in the post-carbon future will have to deal with the realities of an overall warmer, and therefore more unpredictable, climate. Even if regenerative processes are in place to draw down carbon from the atmosphere, this takes time -- and in the process, some of the damage climate change will wreak on our oceans, our forests, our waterways, our coasts, and our soils will be irreversible.

It could take centuries, if not millennia, for the planet to reach a new, stable equilibrium.

But either way, the work of repairing and mitigating at least some of the damage done will be the task of our childrens' children, and their children, and on.

Economic activity in this global society will of necessity be very different to the endless growth juggernaut we have experienced since the industrial revolution. In this post-carbon future, material production and consumption, and technological innovation, will only be sustainable through a participatory 'circular economy' in which scarce minerals and raw materials are carefully managed.

The fast-paced consumerism that we take for granted today simply won't work in these circumstances.

Large top-down national and transnational structures will begin to become obsolete due to the large costs of maintenance, the unsustainability of the energy inputs needed for their survival, and the shift in power to new decentralized producers of energy and food.

In the place of such top-down structures, smaller-scale, networked forms of political, social and economic organization, connected through revolutionary information technologies, will be most likely to succeed. For communities to not just survive, but thrive, they will need to work together, sharing technology, expertise and knowledge on the basis of a new culture of human parity and cooperation.

Of course, before we get to this point, there will be upheaval. Today's fossil fuel incumbency remains in denial, and is unlikely to accept the reality of its inevitable demise until it really does drop dead.

The escalation of resource wars, domestic unrest, xenophobia, state-militarism, and corporate totalitarianism is to be expected. These are the death throes of a system that has run its course.

The outcomes of the struggles which emerge in coming decades -- struggles between people and power, but also futile geopolitical struggles within the old centers of power (paralleled by misguided struggles between peoples) -- is yet to be written.

Eager to cling to the last vestiges of existence, the old centers of power will still try to self-maximize within the framework of the old paradigm, at the expense of competing power-centers, and even their own populations.

And they will deflect from the root causes of the problem as much as possible, by encouraging their constituents to blame other power-centers, or worse, some of their fellow citizens, along the lines of all manner of 'Otherizing' constructs, race, ethnicity, nationality, color, religion and even class.

Have no doubt. In coming decades, we will watch the old paradigm cannibalize itself to death on our TV screens, tablets and cell phones. Many of us will do more than watch. We will be participant observers, victims or perpetrators, or both at once.

The only question that counts is, amidst this unfolding maelstrom, are we going to join with others to plant the seeds of viable post-carbon societies for the next generations of human beings, or are we going to stand in the way of that viable future by giving ourselves entirely to defending our interests in the framework of the old paradigm?

Whatever happens over coming decades, the choices each of us make will ultimately determine the nature of what survives by the end of this pivotal transitional century.

No comments:

Post a Comment